Our Performance

CFO's financial review

Business and financial performance

The Fund achieved commendable performance across most key performance indicators. Total assets, realised income, cost of administration, and contributions all surpassed their budgeted expectations. The asset size grew by 18% to UGX 26 trillion. Additionally, the Fund recognised a significant unrealised foreign exchange gain on the regional investments, especially due to the recovery across all our positions in Kenya.

FY2024/25 Key performance highlights

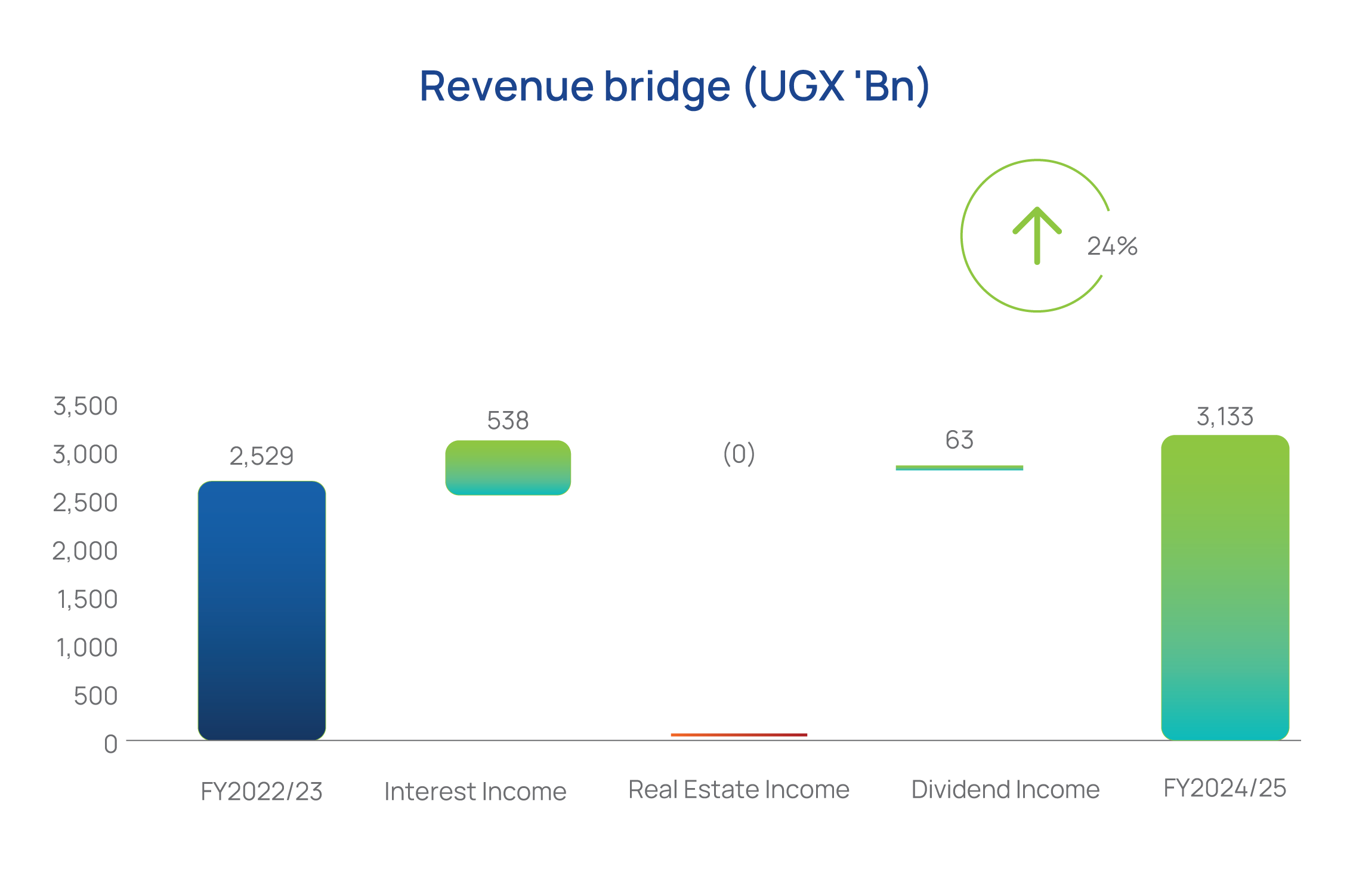

Revenue

- Interest income which makes up over 92% of total income, grew by 23% from UGX 2,340Bn in FY2023/24 to UGX 2,878Bn in FY2024/25. This was driven by higher yields especially in the Kenyan and Uganda market

- Real estate income increased by 25% from UGX 13.29Bn in FY2023/24 to UGX 16.64Bn in FY2024/25 due to rent introduction and increased unit sales in Lubowa compared to the prior year, primarily driven by the discount campaign in house sales in Lubowa

- Dividend income grew by 36% from UGX 175Bn in FY2023/24 to UGX 238Bn in FY2024/25. This was driven by dividend income from (MTN (62Bn), Airtel (36Bn), Equity bank (22Bn), CRDB TZ (19Bn), KCB (16Bn), Safaricom (15Bn), Tanzania Breweries (15Bn), NMB Bank (14Bn), Stanbic (13Bn), EABL (7Bn), Cipla (4Bn) among others

As a result, total realised revenue grew by 24% from UGX 2,529Bn to UGX 3,133Bn driven by the growth in fixed income, dividend income, and real estate income.

Operating costs

- Annual operating costs increased by 4% from UGX 222Bn in FY2023/24 to UGX 230Bn in FY2024/25, and 11.3% below the budget of UGX 256Bn. The increase from the previous period is attributed to the Fund’s continuous strides towards its strategic direction (Vision 2035), driven by initiatives to improve sustainable return and benefits to members through the Fund’s expanded mandate, increased strategic partnerships and engagement, processes to boost internal capacity and innovative solutions to improve efficiencies in the delivery of services to our members

- The annual cost-to-income (Total Income) ratio declined slightly to 7.97% in FY2024/25, down from 9.69% in FY2023/24. This was driven by a UGX 649Bn gain on equities, a forex loss of UGX 274Bn and a loss on Umeme of UGX 117Bn. The expense ratio also improved, reducing to 0.89% in FY2024/25 from 1.00% in FY2023/24, better than the target of 1.04%

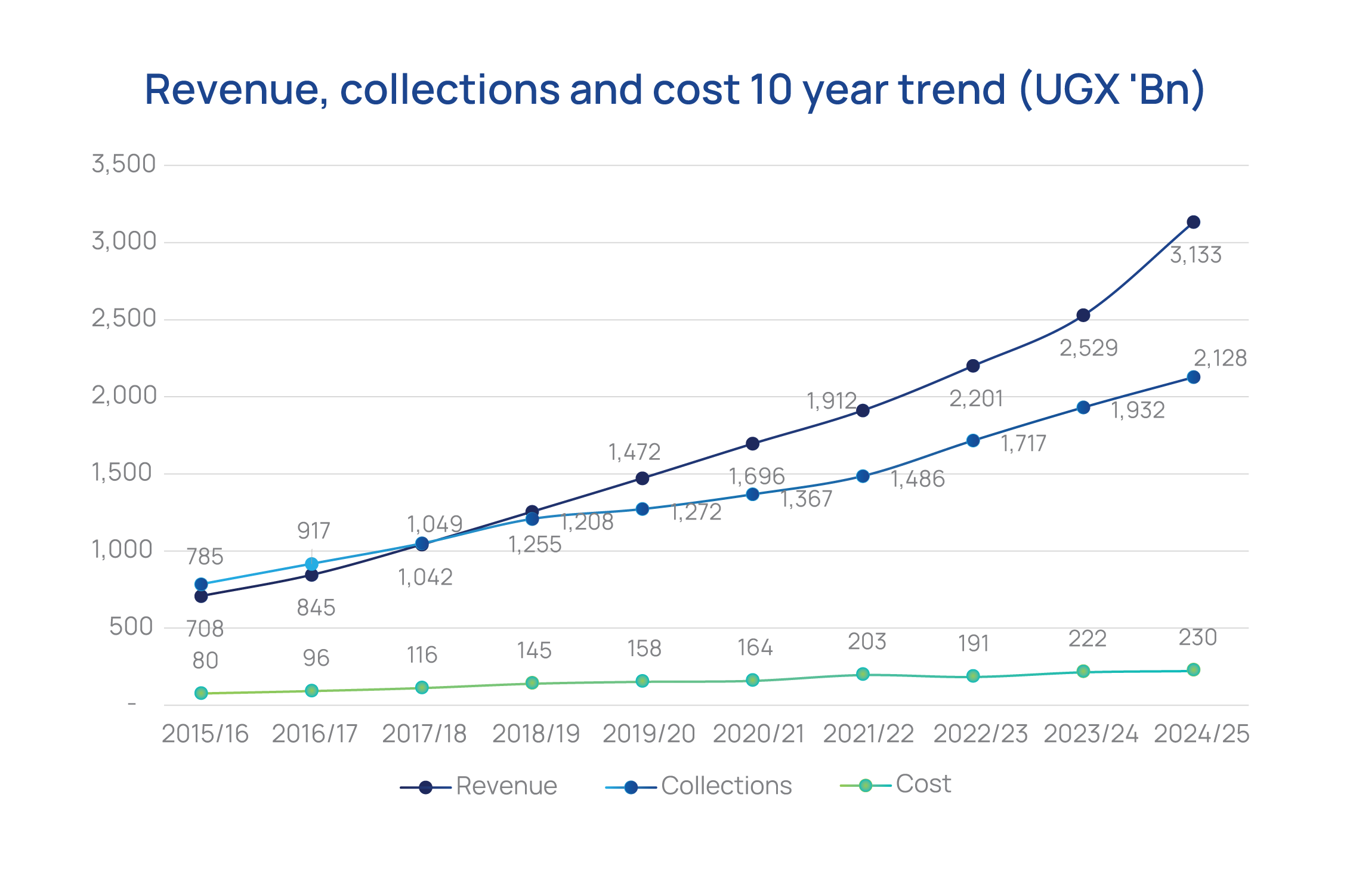

Revenue, collections and cost 10 year trend (UGX'Bn)

- Whereas revenue and collections have grown by a compound annual growth rate (CAGR) of 18% and 12% respectively, costs have only grown by a CAGR 13% over a 10-year period (FY2015/16-FY2024/25). Revenue has posted significant growth over the historical period, and it continually surpassed collections from FY2018/19 onwards. Revenue was higher than collections by 4% in FY2018/19 versus 42% in FY2024/25 and this gap continues to grow.

Interest credited to members

The Fund declared a return to members of 13.5% in FY 2024/25 resulting in UGX 2,797Bn compared to 11.5% in FY 2023/24 which resulted in UGX 2,073Bn.

Financial position

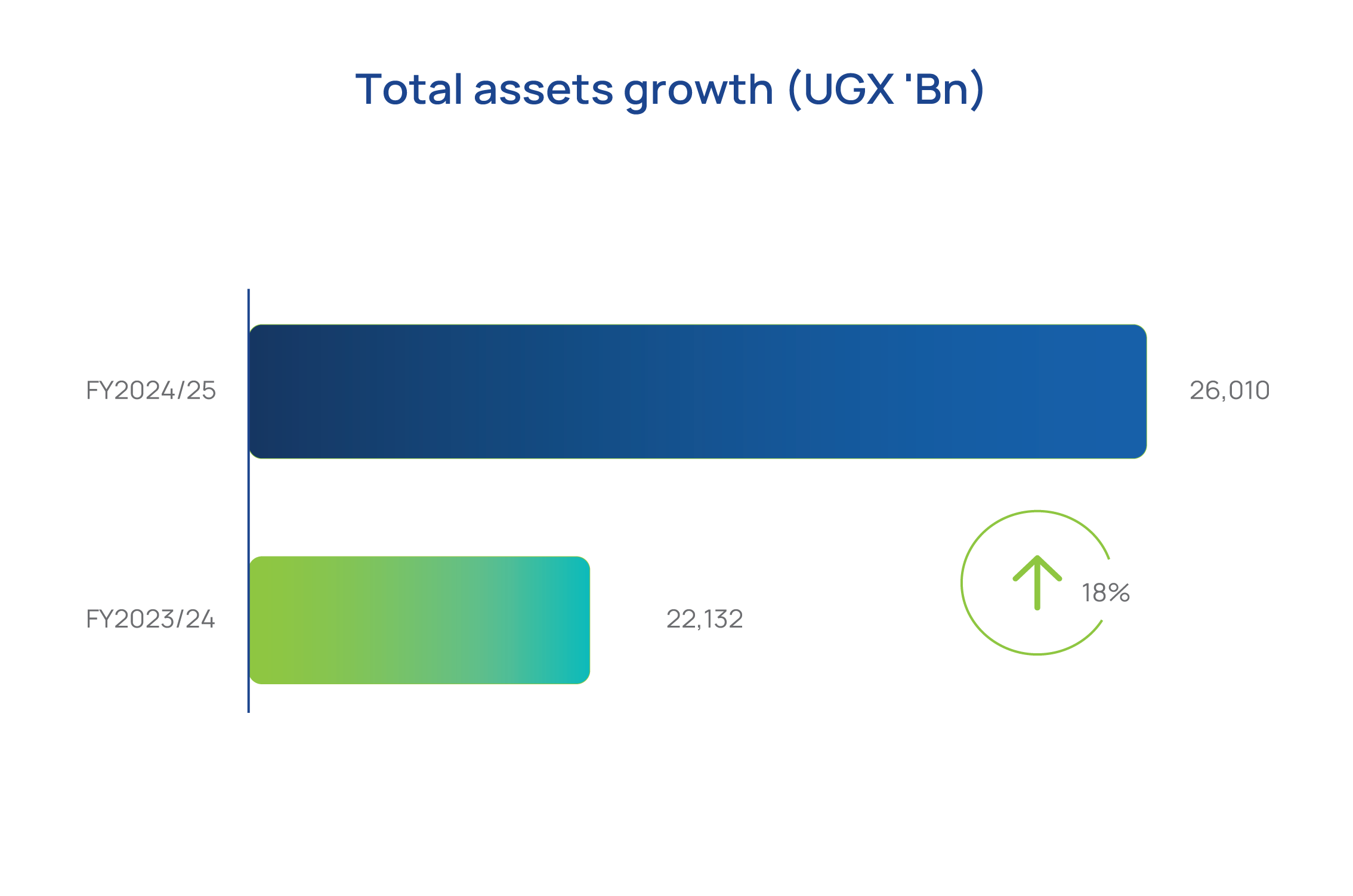

Total assets growth (UGX 'Bn)

- The Fund balance sheet size grew by 18% to UGX 26,010Bn (FY2023/24: UGX 22,132Bn)

- This growth is consistent with the combined growth in investments, driven by contributions and income generated, including unrealised gains, net benefits paid out

- The Fund invests in 3 asset classes: Fixed Income Securities, Equity Securities and Real Estate

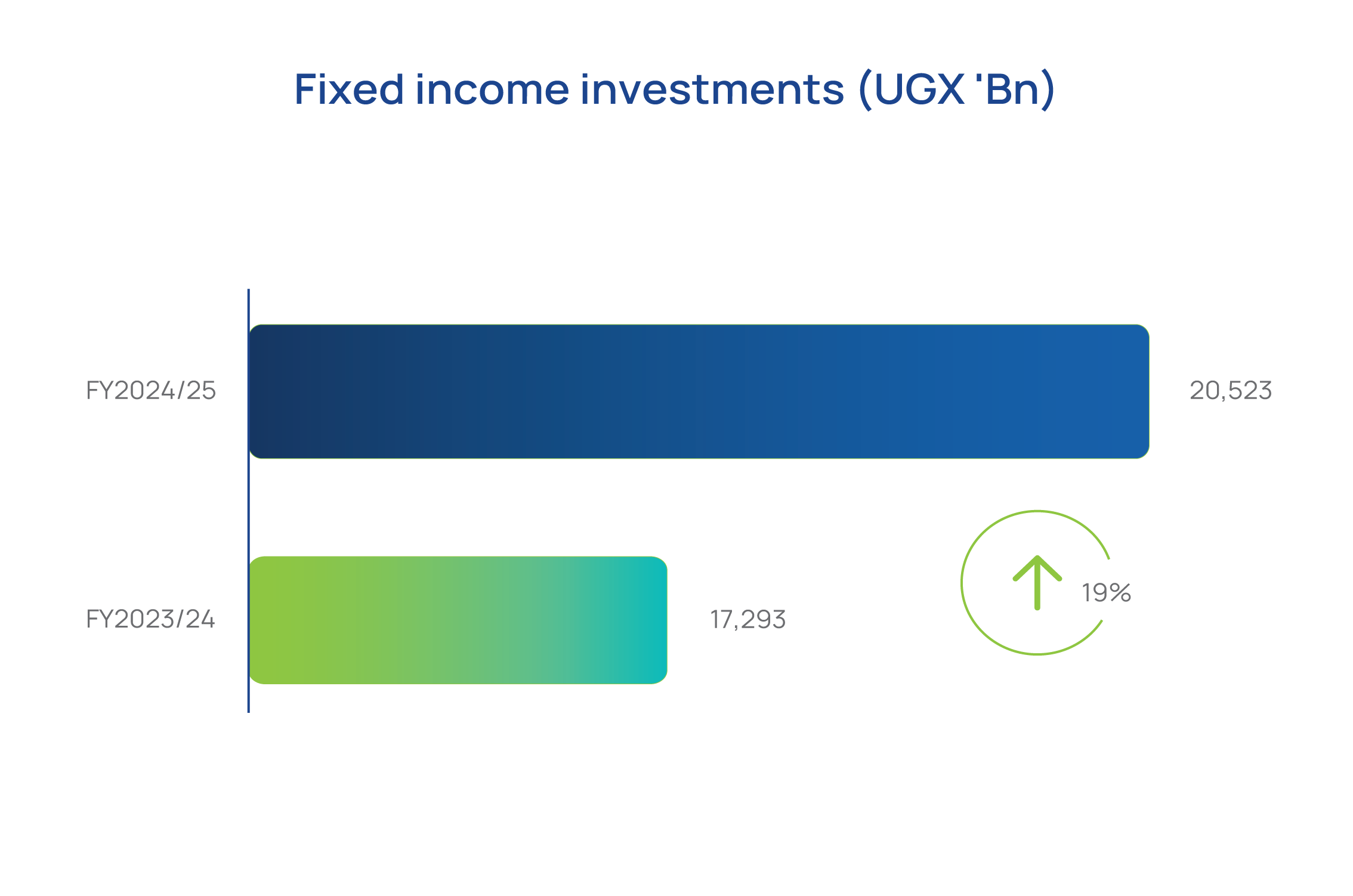

Fixed income investments (UGX 'Bn)

- The 19% growth in Fixed income investments to UGX 20,523Bn (FY2023/24: UGX 17,293Bn) was due to increased allocations to this asset class.

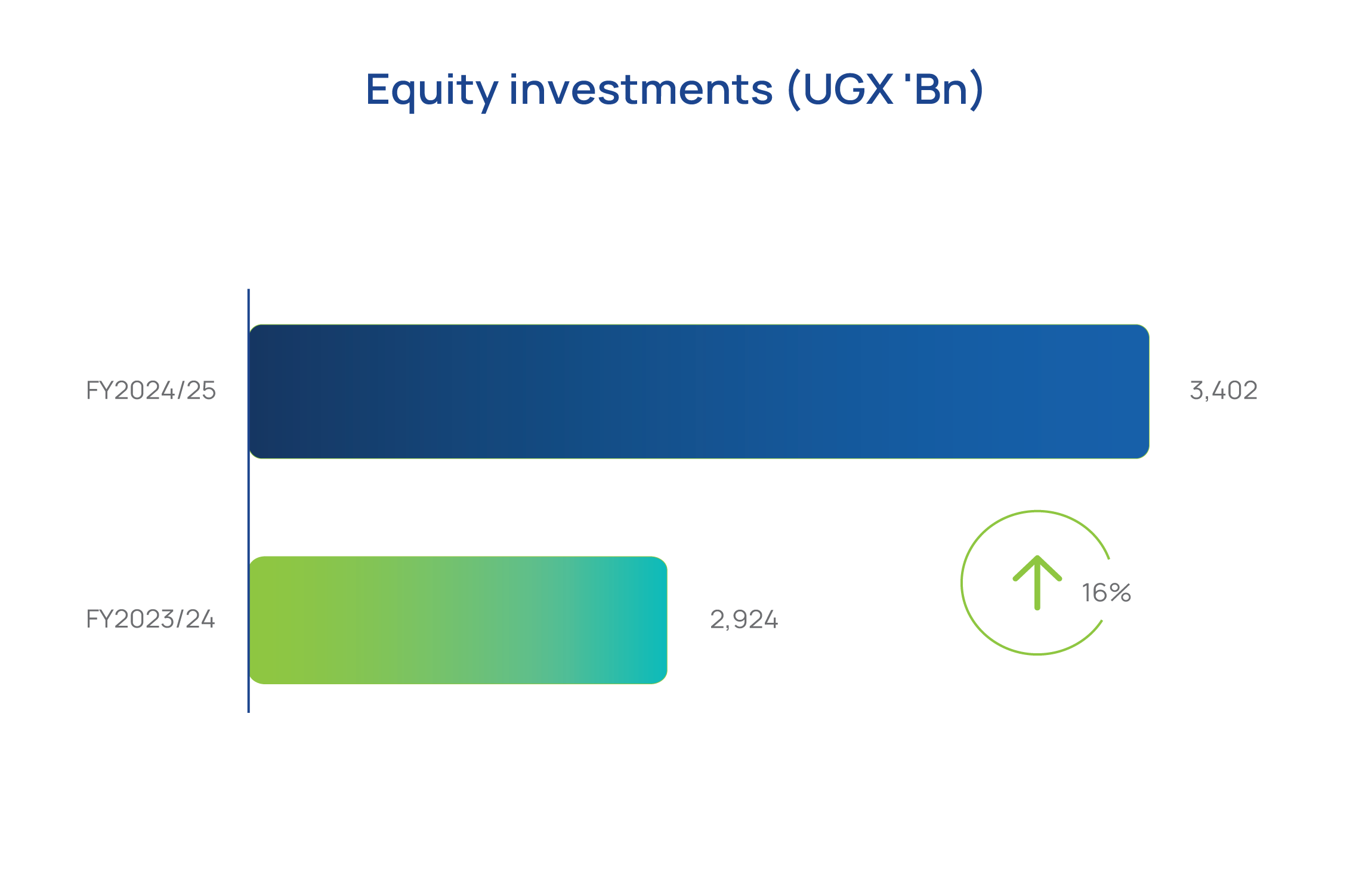

Equity Investments (UGX 'Bn)

- Equity investments increased by 16% to UGX 3,402Bn (FY2023/24: UGX 2,924Bn) attributed to gains from rising share prices for several equities, additional shares from KCB Kenya, UMEME and the appreciation of the Kenyan shilling, which further amplified market performance.

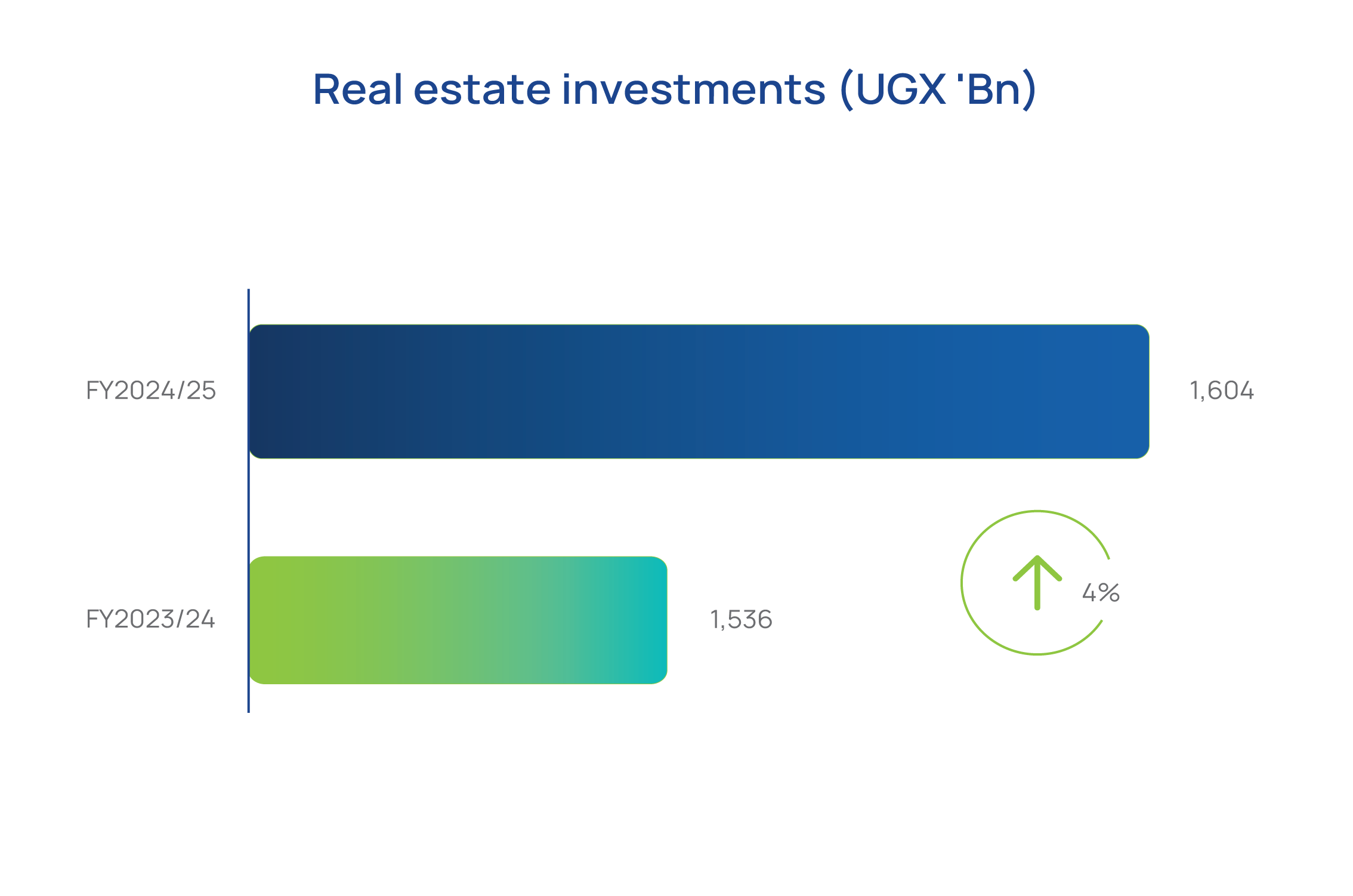

Real Estate Investments (UGX 'Bn)

- Real estate investments increased by 4% to UGX 1,604Bn (FY2023/24: UGX 1,536Bn) due to progress with ongoing projects including Pension Towers, Temangalo, Mbale and Yusuf Lule.

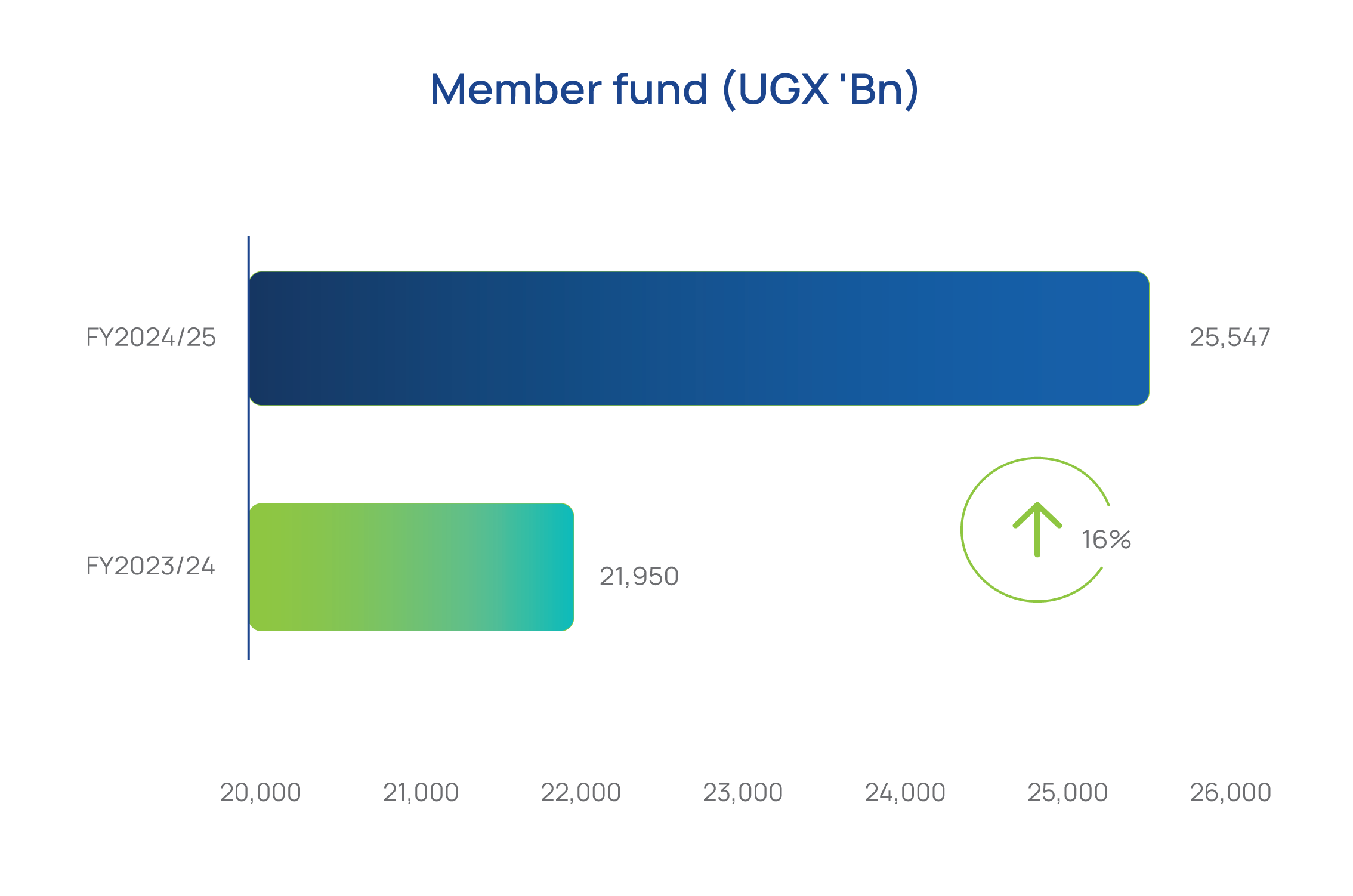

Accumulated member fund (UGX 'Bn)

- Member fund grew by 16% to UGX 25,547Bn (FY2023/24: UGX 21,950Bn) driven by contribution collections of UGX 2,128Bn and interest credited to members of UGX 2,797Bn net of total benefits paid of UGX 1,323Bn.