Our Business

Financial and operational highlights

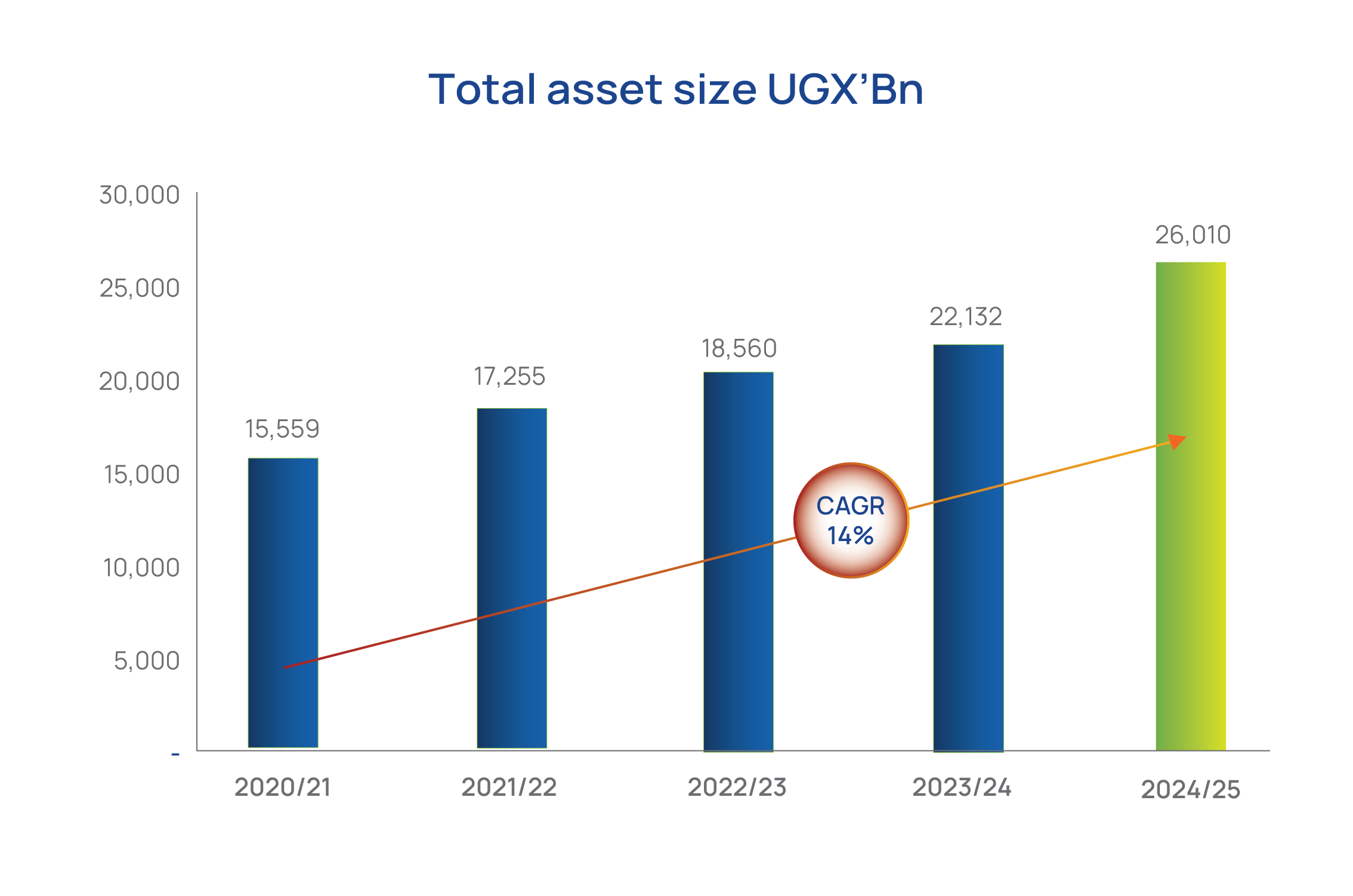

Total asset size UGX'Bn

- The Fund balance sheet size grew by 18% to UGX 26,010Bn (FY2023/24: UGX 22,132Bn)

- This growth is consistent with the combined growth in investments, driven by contributions and income generated, including unrealised gains, net benefits paid out

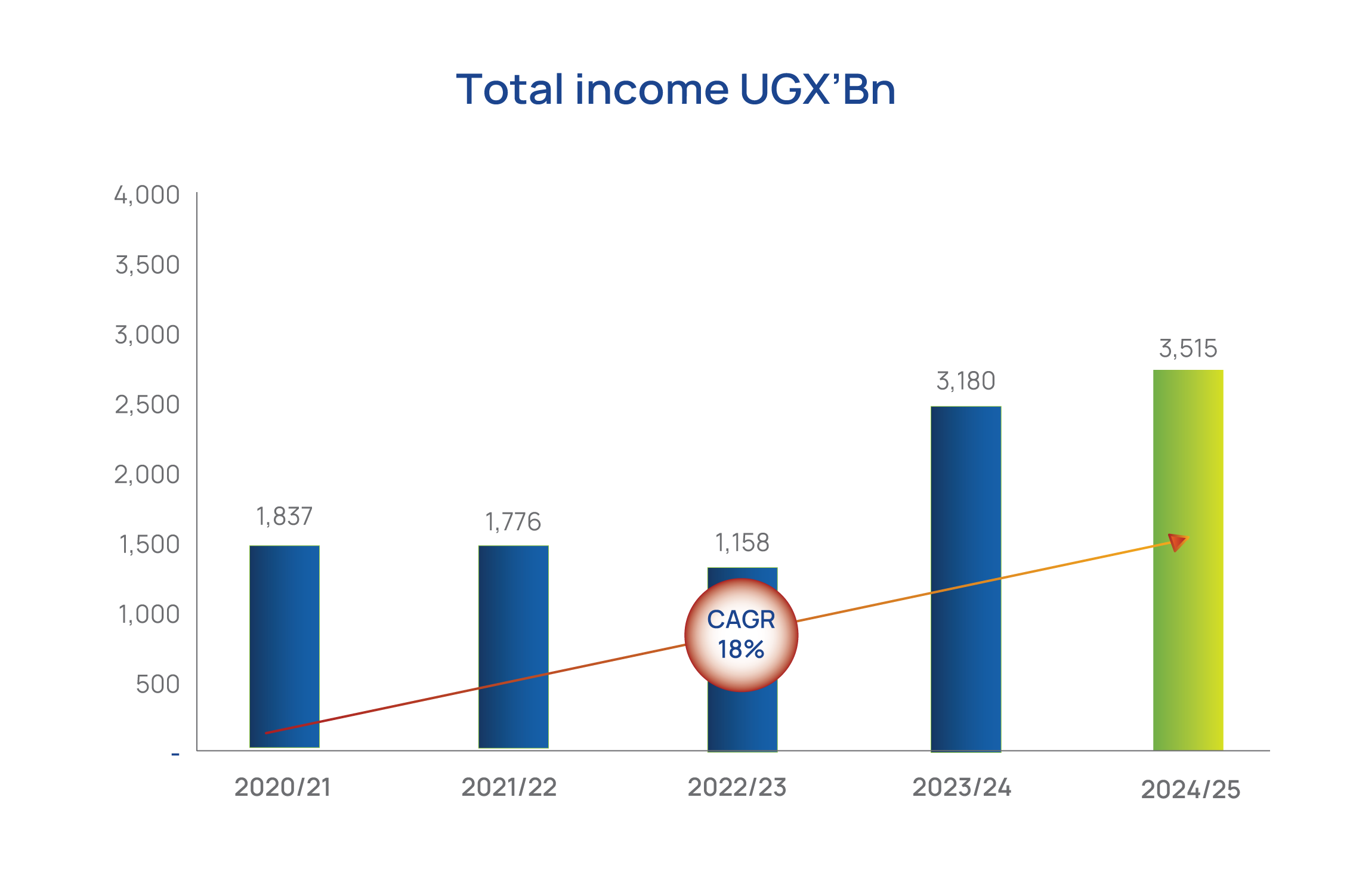

Total income UGX'Bn

- Total income grew by 11% to UGX 3,515 billion, of which UGX 3,133 billion was realised income. Interest income accounted for 92%, dividend income contributed 7.6%, while the balance was derived from real estate income

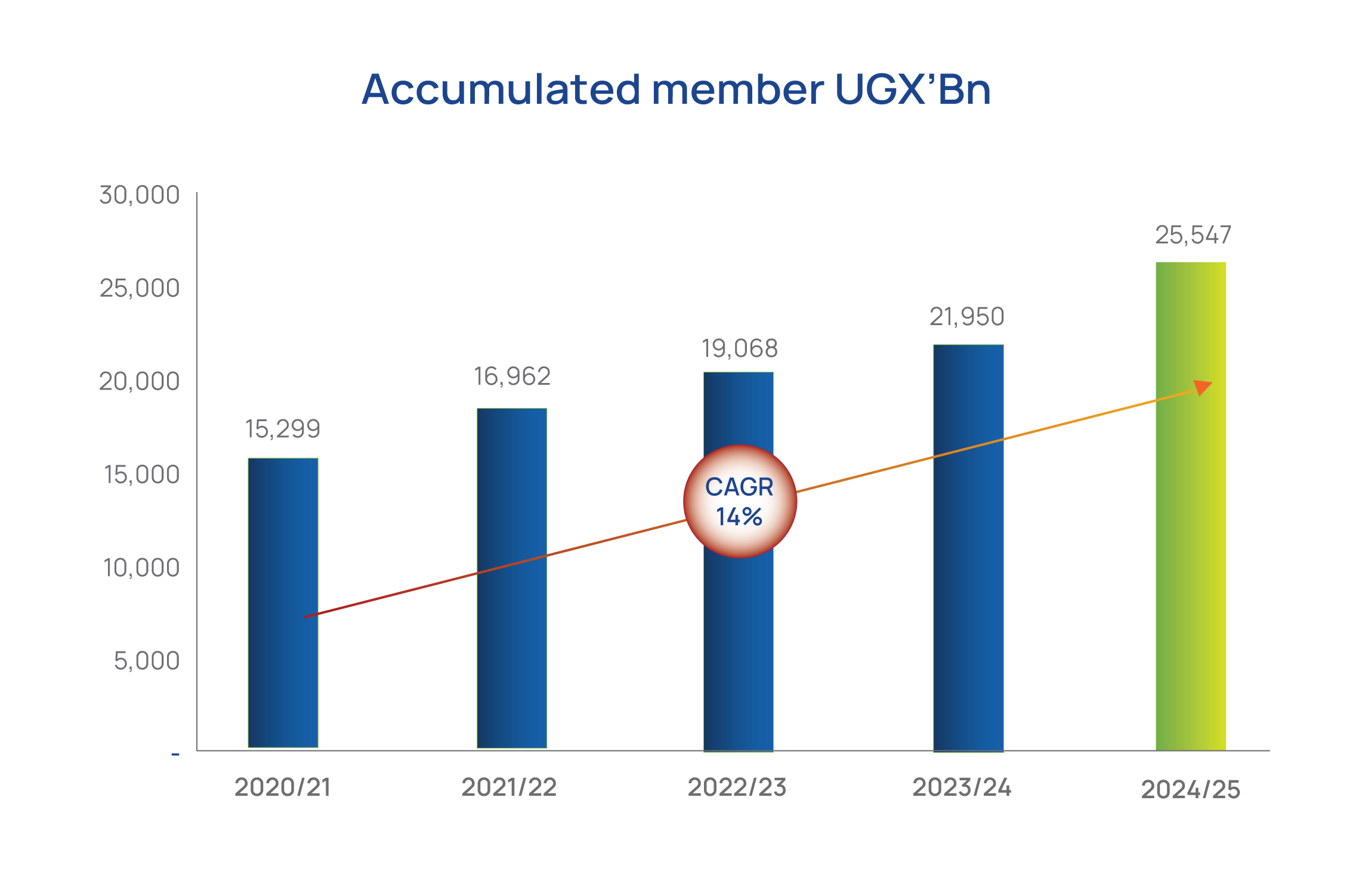

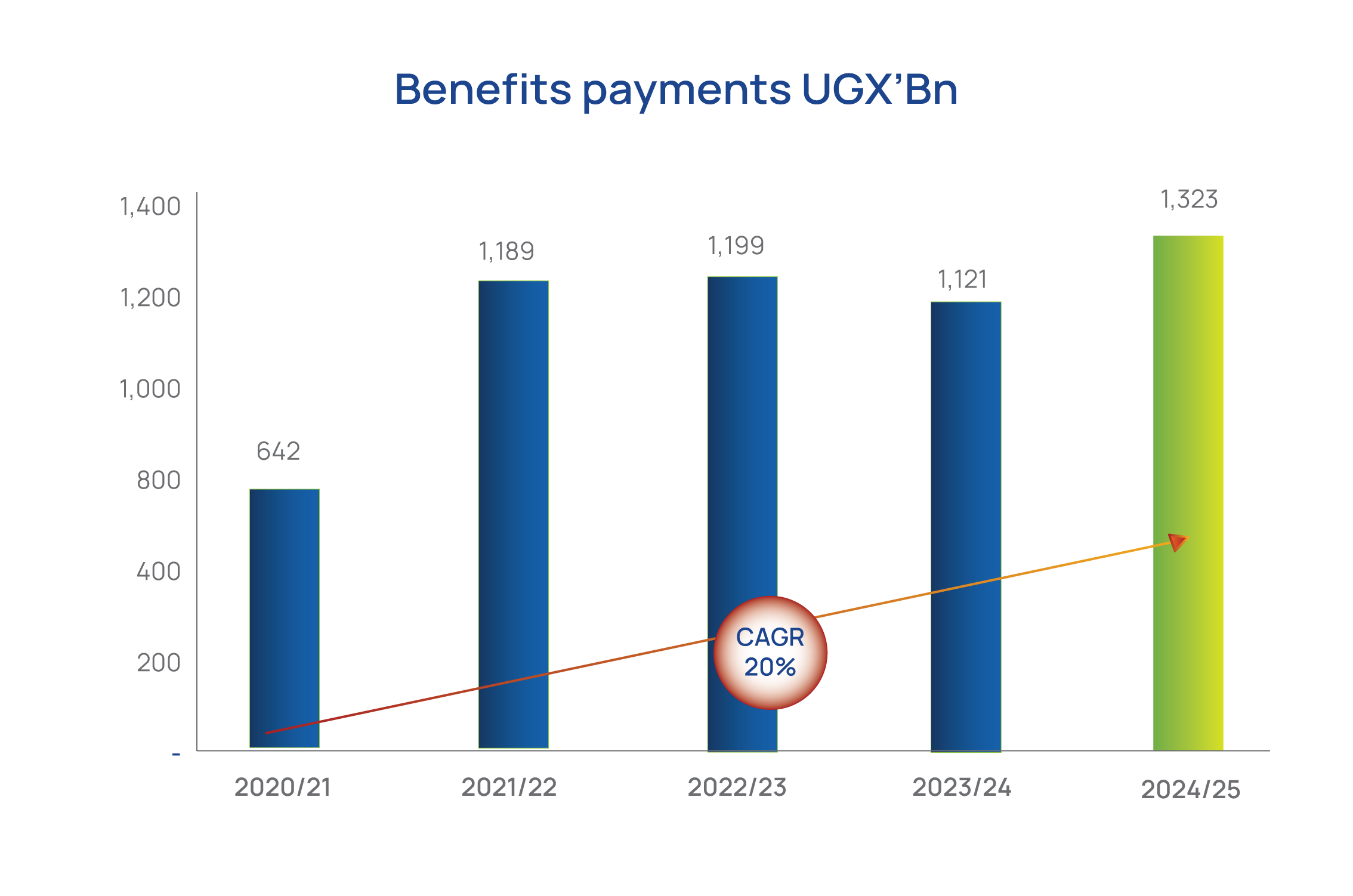

Accumulated member UGX'Bn

- Member fund grew by 16% to UGX 25,547Bn (FY2023/24: UGX 21,950Bn) driven by contribution collections of UGX 2,128Bn and interest credited to members of UGX 2,797Bn net of total benefits paid of UGX 1,323Bn

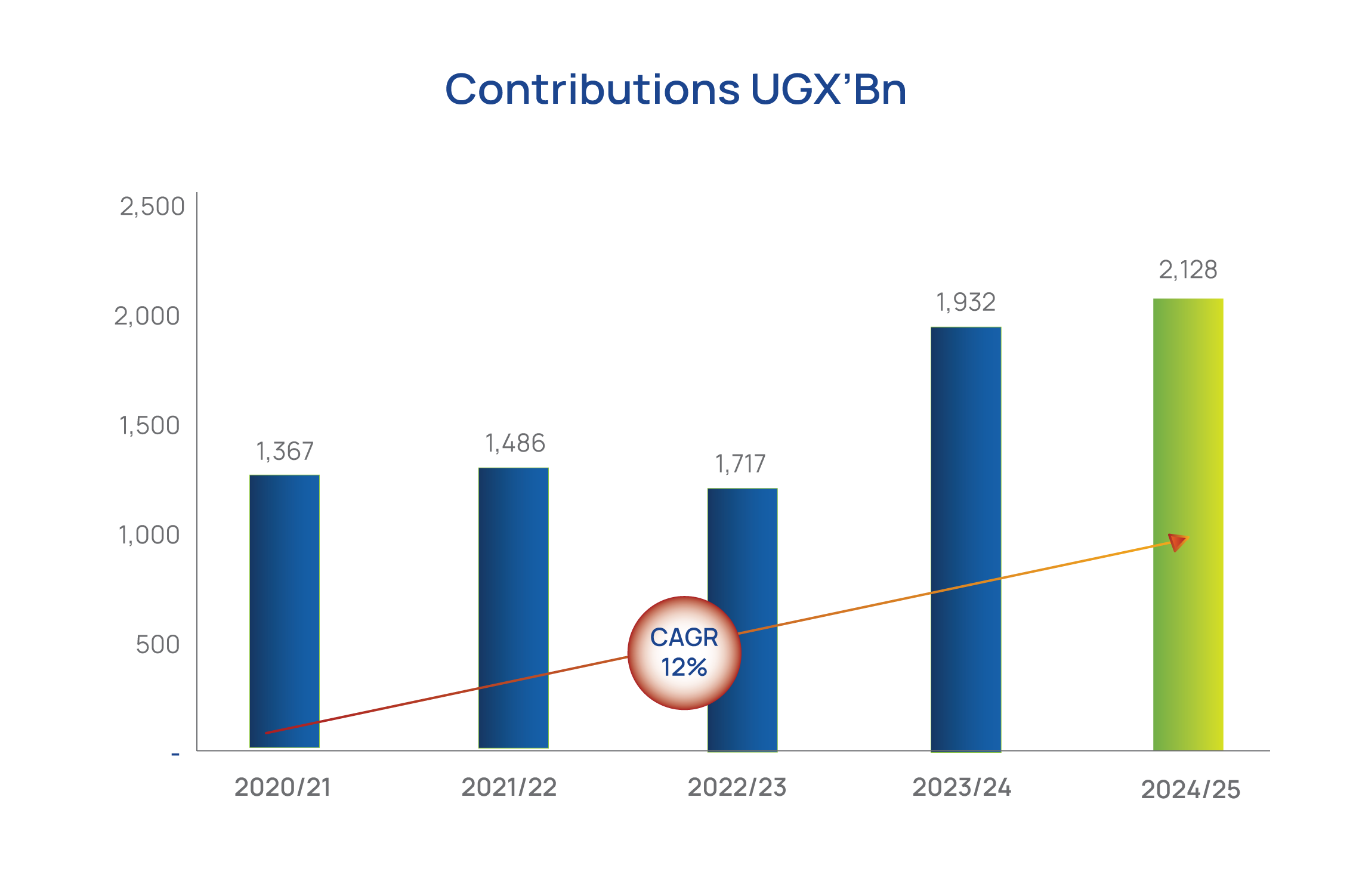

Contributions UGX'Bn

- Contributions grew by 10%, from UGX 1,932 billion to UGX 2,128 billion, driven by the strong uptake of voluntary savings, especially through the newly introduced Smartlife product

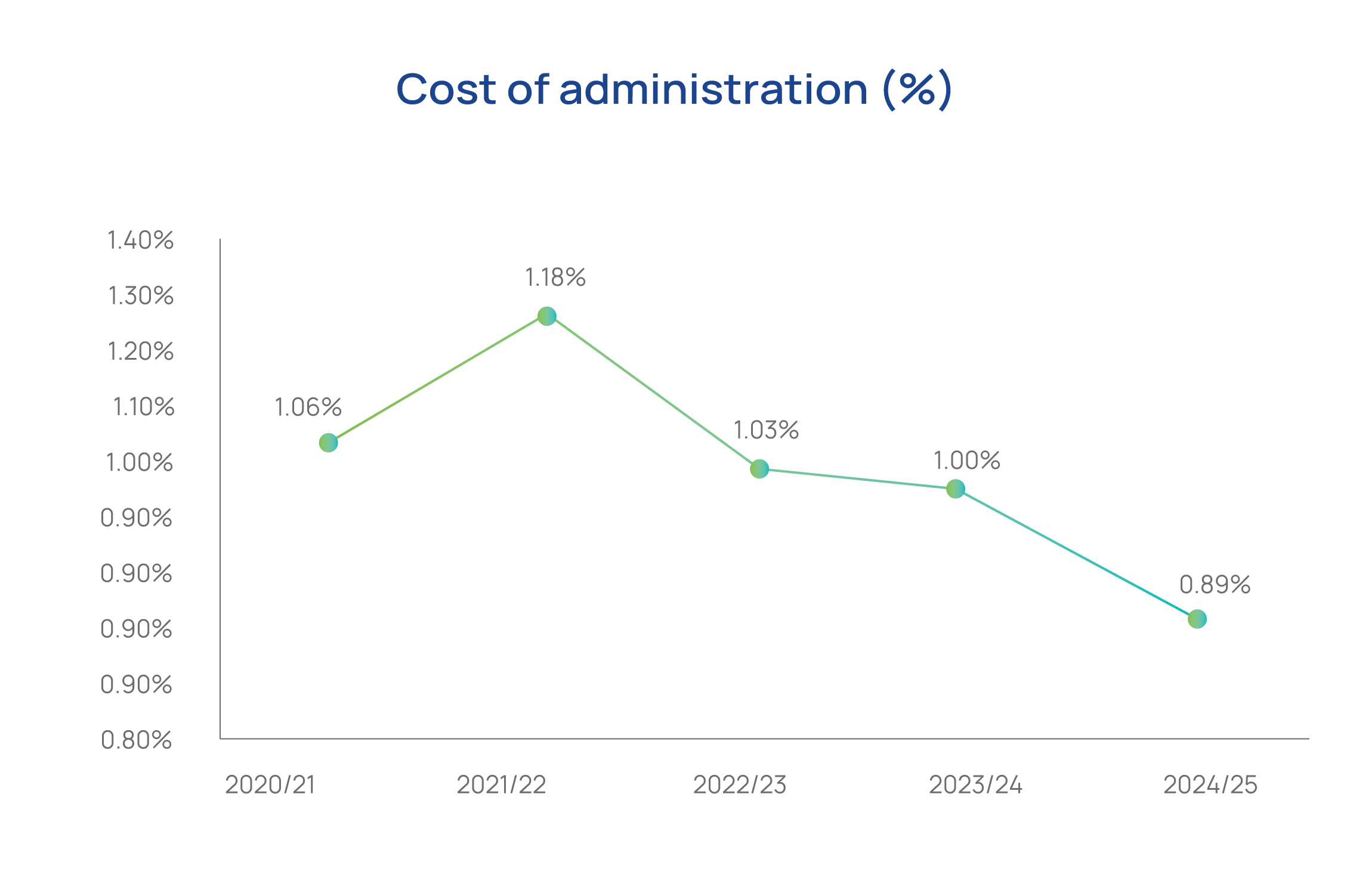

Cost of administration UGX'Bn

- The expense ratio reached a historic low of 0.89%, reflecting the success of value-based budgeting and disciplined cost management

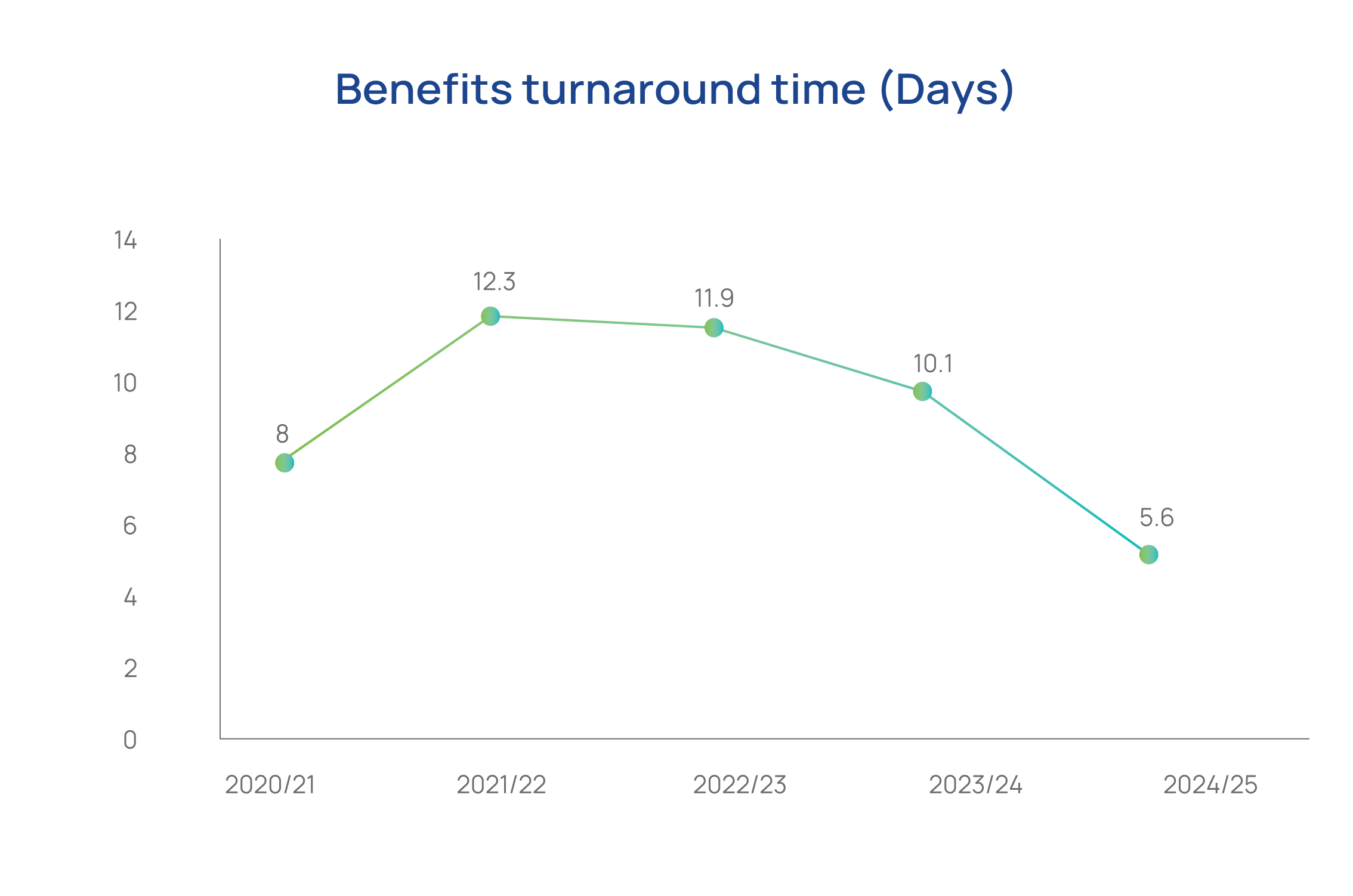

Benefits turnaround time (Days)

- In line with our goal of increasing efficiency to improve service delivery, the Fund made remarkable progress in reducing the turnaround time for benefit payments. Through process reorganisation, improved approval workflows, and a focus on operational excellence, we reduced the TAT to a record low of 5.6 days, compared to 10.1 days the previous year.

Benefits payments UGX'Bn

- Benefits paid increased by 18% to UGX 1,323 billion, driven by higher withdrawals under the age benefit

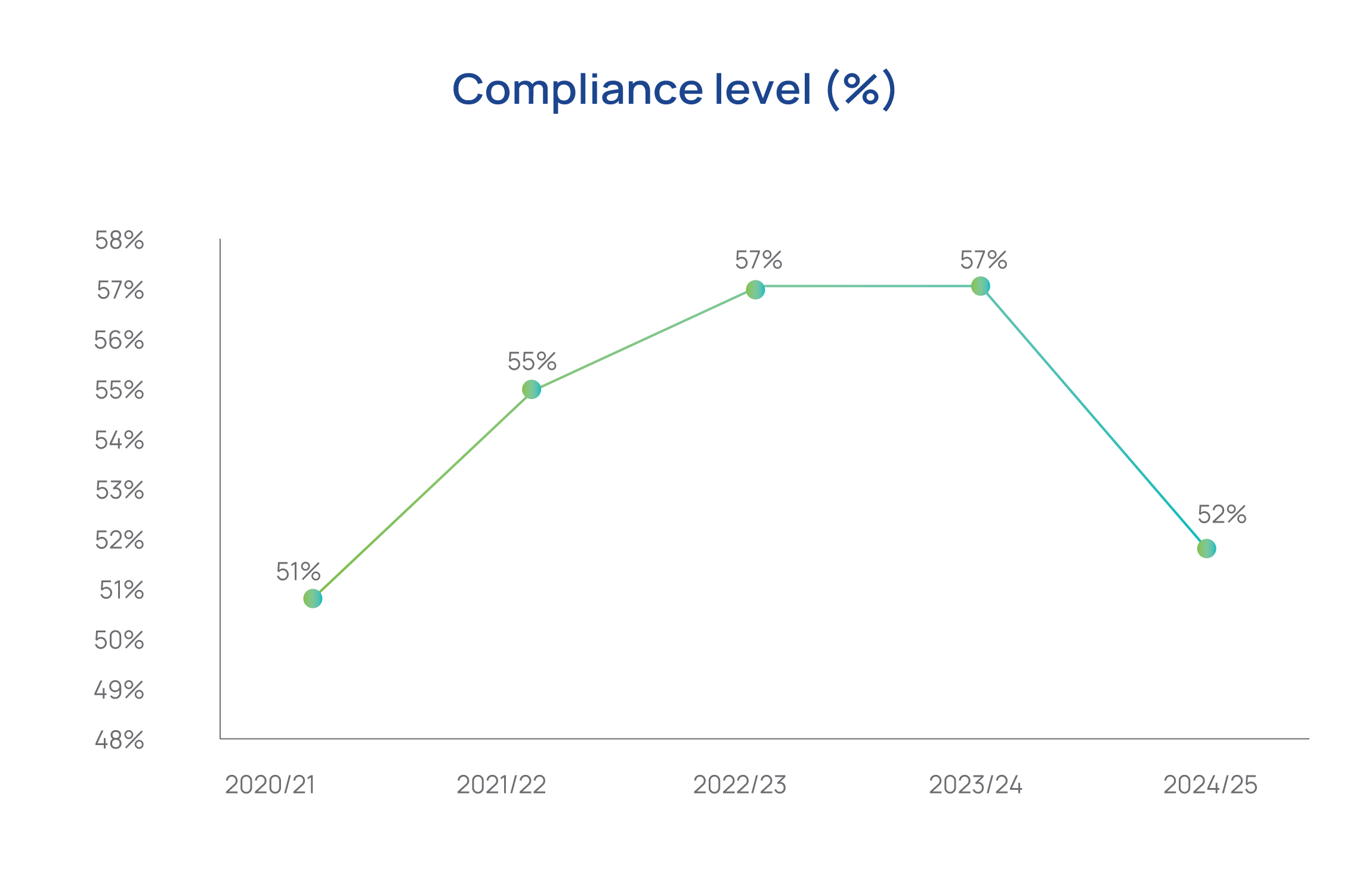

Compliance level UGX'Bn

- Although employer compliance declined to 52%, largely due to an increase in newly registered employers who had not yet begun remitting contributions, total collections still increased