Our Performance

CIO's business review

Kenneth Owera, Acting Chief Investment Officer

"As NSSF Uganda celebrates 40 years of service, the Fund’s commitment to delivering lasting value to our members remains central to everything we do. This year’s 13.51% return, coupled with assets under management reaching UGX 26 trillion, reflects both prudent stewardship and strong member confidence. The Fund recently launched a 2035 Strategy which has set an ambitious course, doubling these assets to UGX 50 trillion, increasing coverage to 50% of the working population and achieving 95% staff and customer satisfaction. This roadmap builds on the Fund’s legacy of financial security, positioning us to deliver even greater value to both our members and Uganda, in the decade ahead."

Economic developments in FY2024/25 unfolded against a global backdrop of resilience, tempered by uncertainty. While trade tensions and geopolitical risks weighed on sentiment, moderating inflation and supportive financial conditions underpinned global growth. Africa sustained its recovery, with East Africa remaining a top-performing subregion.

Uganda’s economy accelerated to 6.3% growth, driven by robust performance of commodity exports, infrastructure investment, and a stable macroeconomic environment. Looking ahead, sustained growth above 6.0% is expected, supported by oil sector activity and continued public investment, though political stability will be key to managing risks.

The Fund’s investment strategy in FY 2024/25 remained anchored in diversification, stability, and the pursuit of opportunities. Fixed income, representing the largest proportion of assets, returned 14.1% driven by the country strategy, as we reallocated funds into the higher yielding Uganda bond market amidst a region wide monetary easing environment. Equities outperformed the benchmark, returning 25.2%, supported by resilient corporate earnings and monetary tailwinds in the region.

Real estate remained a strategic diversification pillar in the Fund’s portfolio, combining long-term income generation with tangible contributions to Uganda’s physical landscape. During the year, the portfolio focus was centred on unlocking value through a sales revitalisation strategy; and reinvestment of flows into flagship developments covering affordable housing in Temangalo and commercial property in Kampala.

The Fund enters FY2025/26 with momentum, clarity of purpose, and the financial strength to kickstart our renewed 2035 vision. Our strategic focus will remain anchored on balancing growth with resilience, maintaining a disciplined capital allocation approach that delivers above average inflation returns, while reinforcing the Fund’s role as a catalyst for Uganda’s development.

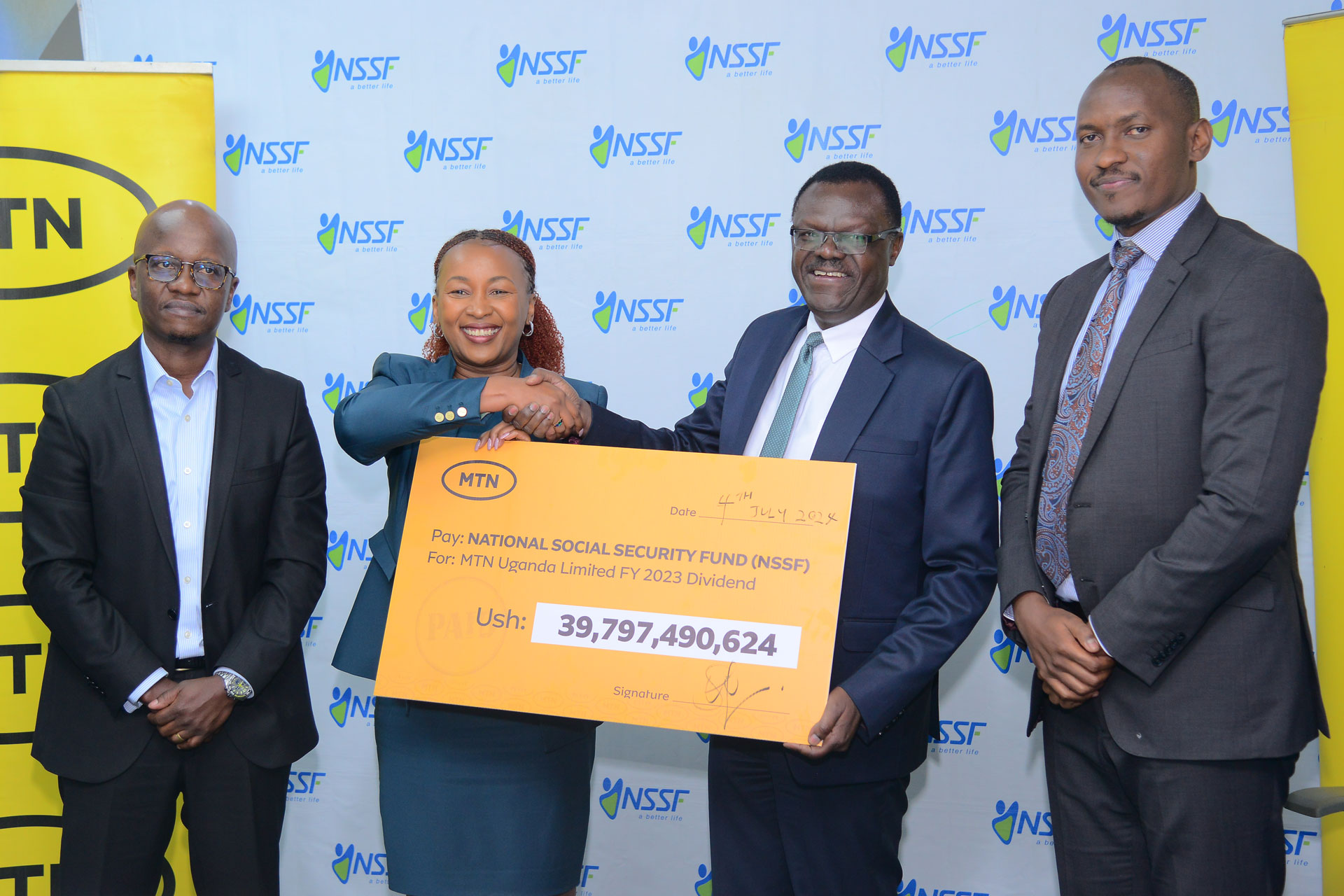

Key priorities shall include increasing social impact by deepening exposure to infrastructure-linked opportunities, expanding into alternative equity assets, and sustaining disciplined exposure to dividend-paying businesses in fundamentally sound markets.

We will continue to unlock real estate value through timely delivery, targeted sales, and expansion into affordable housing, complemented by blended financing for projects undertaken by the Fund, while embedding sustainability in design and construction.

Against a dynamic economic backdrop, the Fund remains committed to disciplined execution, prudent capital allocation, and innovation that places members at the centre of our investment strategy.

The sections that follow present an overview of key economic and market developments in FY2024/25, a detailed account of the Fund’s performance, and the strategic priorities that will shape the next phase of our growth.

Member value and the Fund strategy

The member is central to everything we do at the Fund. As we mark 40 years of service, this milestone offers an opportunity to reflect on the long-term value created for our members and for the Ugandan economy. In FY2024/25, the Fund concluded an independent True Value Assessment conducted by KPMG, which sought to quantify the total impact of the Fund’s activities on society over a 10-year period, 2014-2024. The report showed that the largest value created was through the Fund’s ability to provide financial security for its members, estimated at UGX 15.5 trillion in 2024.

It also highlighted the consistency of the Fund’s financial performance, delivering an average return of 11.6% over the past 10 years, during the implementation of the Fund’s Vision 2025 strategy.

This long-term return trajectory has further been enhanced in FY2024/25 with a 13.51% return, outperforming historical averages and preserving member value in real terms.

Over the past four decades, the Fund has translated this value into tangible, long-term investments that shape Uganda’s physical and economic landscape. These include iconic developments such as Workers’ House, Social Security House, and the ongoing Pension Towers; as well as transformative residential and mixed-use projects such as Solana Lifestyle and Residences and the upcoming Temangalo Housing Estate. Beyond the physical landscape, the Fund has also played a catalytic role in Uganda’s capital markets, acting as a long-term anchor investor in government securities, which help fund critical public services and infrastructure such as roads, schools, and hospitals.

In the private sector, the Fund has provided long-term capital to publicly listed companies and strategic private enterprises, supporting business growth, job creation, and industrial expansion. Together, these investments reflect the Fund’s dual commitment to growing member wealth and fostering broad-based national development.

A central objective of Vision 2025 was to grow the Fund’s assets under management to UGX 20 trillion. By June 2025, at the close of the strategy period, the Fund had not only achieved this goal but surpassed it by 30%, reaching UGX 25.996 trillion. This milestone underscores the Fund’s prudent investment stewardship and the sustained confidence of our members in its long-term strategy.

Looking ahead, the Fund has formulated a 2035 Strategy, which will coincide with its half century existence. It sets an ambitious but achievable roadmap to deepen member value over the next decade, by growing assets under management to UGX 50 trillion, increasing coverage to 50% of the working population and achieving 95% staff and customer satisfaction.

The Investment Department will play a pivotal role in achieving these targets, particularly in scaling up the Fund’s asset base. Growth in member assets will continue to be driven by two core pillars: investment income and member contributions. Realising this vision will require the deployment of prudent, forward-looking investment strategies designed to withstand diverse economic cycles and deliver stable, long-term returns.