Our Performance

CIO's business review

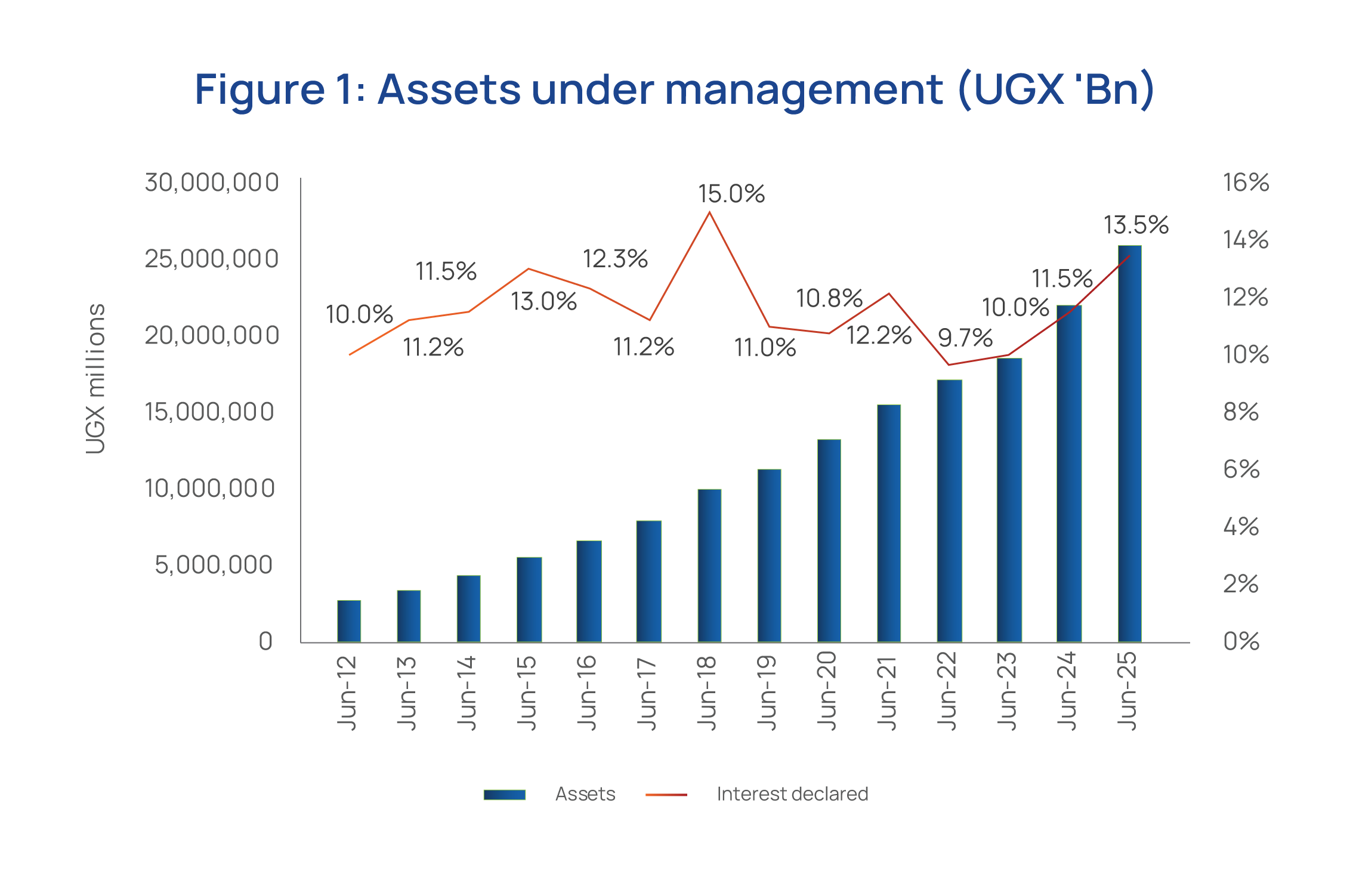

The following sections outline the key economic developments observed in FY2024/25, the Fund’s outlook for the upcoming year, their implications for the members’ portfolio, and the investment strategies that will drive the next phase of growth toward the UGX 50 trillion target.

Economic developments and outlook

Over the past year, the global economic environment has been marked by heightened uncertainty, largely stemming from shifts in U.S. trade policy.

While Africa, and East Africa in particular, remained among the world’s resilient growth regions, global spillovers, tighter financing conditions, and political transitions continue to narrow fiscal space and test policy agility.

Uganda has sustained a robust growth trajectory, supported by strong domestic investment and macroeconomic stability. However, the outlook remains tempered by electoral pressures and rising global uncertainty in the short to medium term.

Global economy: A world balancing resilience and uncertainty

The global economy demonstrated relative resilience during FY2024/25, despite persistent uncertainty from trade tensions and geopolitical instability. Inflation moderated while financial conditions improved, though market sentiment remained fragile.

Global growth for the calendar year 2024 was estimated at 3.1% (OECD), while the IMF revised down its 2025 forecast from 3.3% to 3.0%. Global inflation averaged 5.8% in 2024, with forecasts to decline to 4.2% in 2025, led by easing food and fuel prices. The U.S. economy experienced an annualised contraction of 0.5% in Q1 2025, attributed to front-loaded imports before new tariffs took effect.

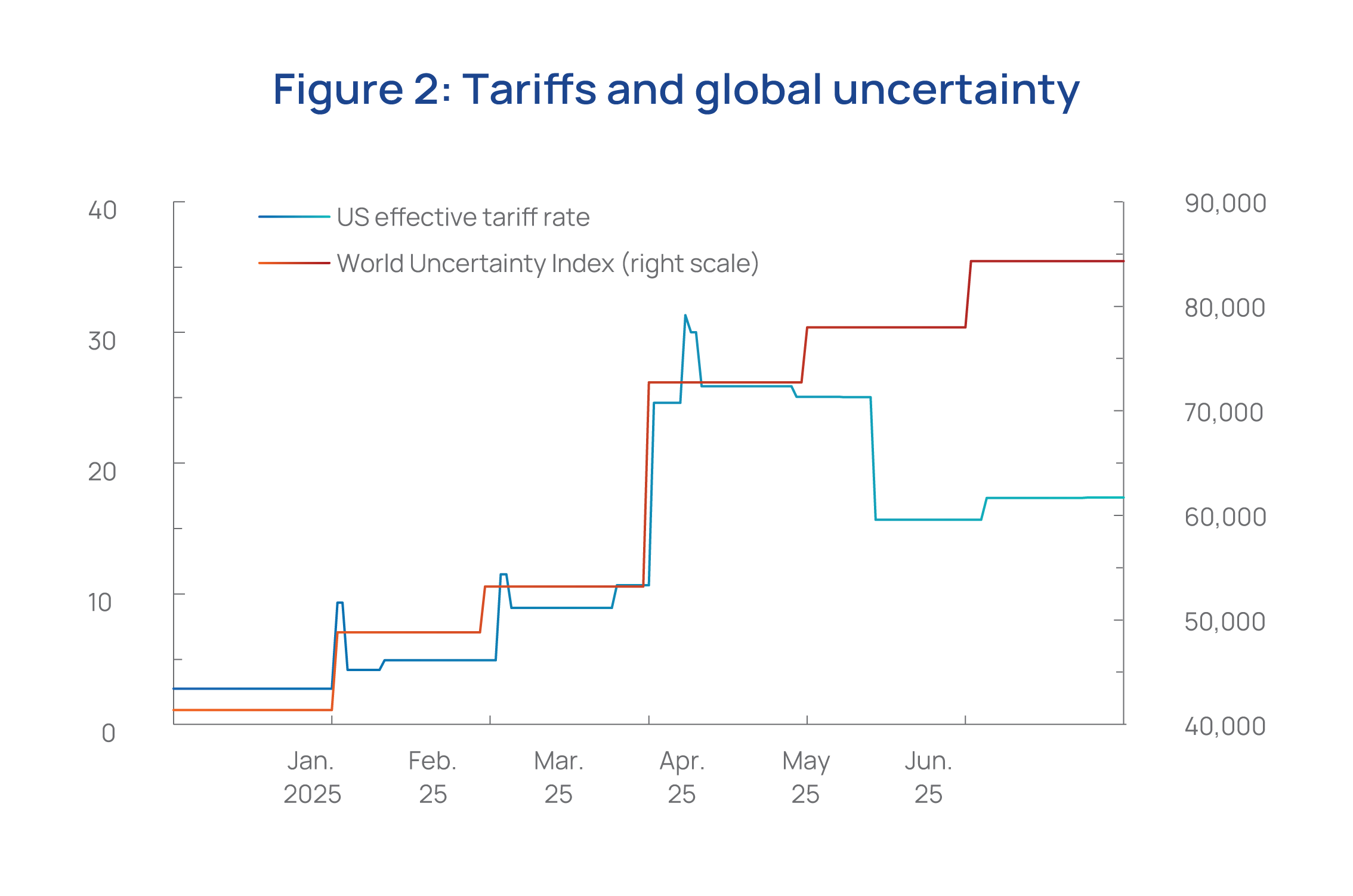

Improved economic conditions were later realised as effective tariffs imposed were eventually lower than expected, particularly between the US and China (Figure 2). Meanwhile, China’s growth rebounded to 6.0% in early 2025, supported by a weaker renminbi and export diversification.

Monetary policy diverged across regions. Advanced economies began pausing or reversing rate hikes, while many emerging markets, having front-loaded their tightening cycles earlier, cautiously transitioned to easing stances.

Africa: Calm headwinds, active reform

During FY2024/25, Africa’s macroeconomic environment stabilised. Sub-Saharan Africa grew by an estimated 3.8% in 2024, and is projected to grow at 4.0% in 2025, supported by infrastructure investment and rising commodity exports.

Continental inflation declined to 10.2% in 2024, from 13.7% in 2023, helped by improved food supply and lower global prices. Central banks in countries such as Ghana, Angola, and South Africa initiated easing cycles, although depreciation pressures persisted. Public debt burdens remained high, prompting continued engagement with IMF programmes aimed at improving fiscal sustainability.

East Africa: Diverging politics, low inflation, shared growth

East Africa remained one of Africa’s most dynamic subregions in FY2024/25, supported by strong real sector performance. However, elevated political risks and fiscal pressures continued to weigh on outlooks across select economies.

In Kenya, growth remained stable despite civil unrest from politically driven riots. GDP growth for the calendar year 2024 was estimated at 4.9% and is projected to grow at 5.0% in 2025. Inflation averaged 3.4% in FY2024/25, within the central bank’s target range. This allowed the central bank to cut rates by 300 bps during the financial year, from 12.75% to 9.75%. The fiscal space remained expansionary, with the fiscal deficit at 5.5% of GDP.

In Tanzania, growth remained robust at 5.2% in 2024 and is projected to grow at 6.0% in 2025. Inflation averaged just 3.2% in FY2024/25, attributed to stable food and energy prices. Like in Kenya, this allowed the central bank to maintain an accommodative monetary policy stance, keeping the policy rate at 6% throughout the financial year. Fiscal policy remained mildly expansionary, with a deficit at around 3.3% of GDP.

In Rwanda, GDP growth was estimated at 8.9% in 2024, up from 8.2% in 2023. Inflation averaged 4.2% in FY2024/25, increasing in the second half of the year, influenced by a depreciating franc. The central bank, however, maintained an accommodative policy, decreasing the central bank rate from 7.0% to 6.5% in August 2024 and holding this level throughout the year. The fiscal deficit widened to 6.9% of GDP, driven by airport investments and a rising wage bill.

Uganda: Commodity tailwinds and infrastructure spending

Uganda’s economic performance during FY2024/25 was buoyed by strong commodity exports and public investment. Real GDP grew by an estimated 6.3% over the financial year, above the 5.3% growth registered in FY2023/24. Gold and coffee exports supported a narrowing of the current account deficit to 7.1% of GDP, down from 9.3% the previous year. Together with inflows from foreign investment and sustained oil prices, these enabled the currency to appreciate by 2.4% during the financial year.

Inflation averaged 3.4% over FY2024/25, reflecting shilling appreciation and softening global commodity prices. The central bank eased policy rates by 50 bps between June and October 2024, and held steady at 9.75% for the rest of the financial year.

The fiscal deficit widened to 5.2% of GDP, up from 4.7% in FY2023/24, while public debt rose to 50.7% of GDP by March 2025; mainly attributed to increased infrastructure spending.