Our Performance

CIO's business review

Looking ahead: Anchored optimism, political watchpoints

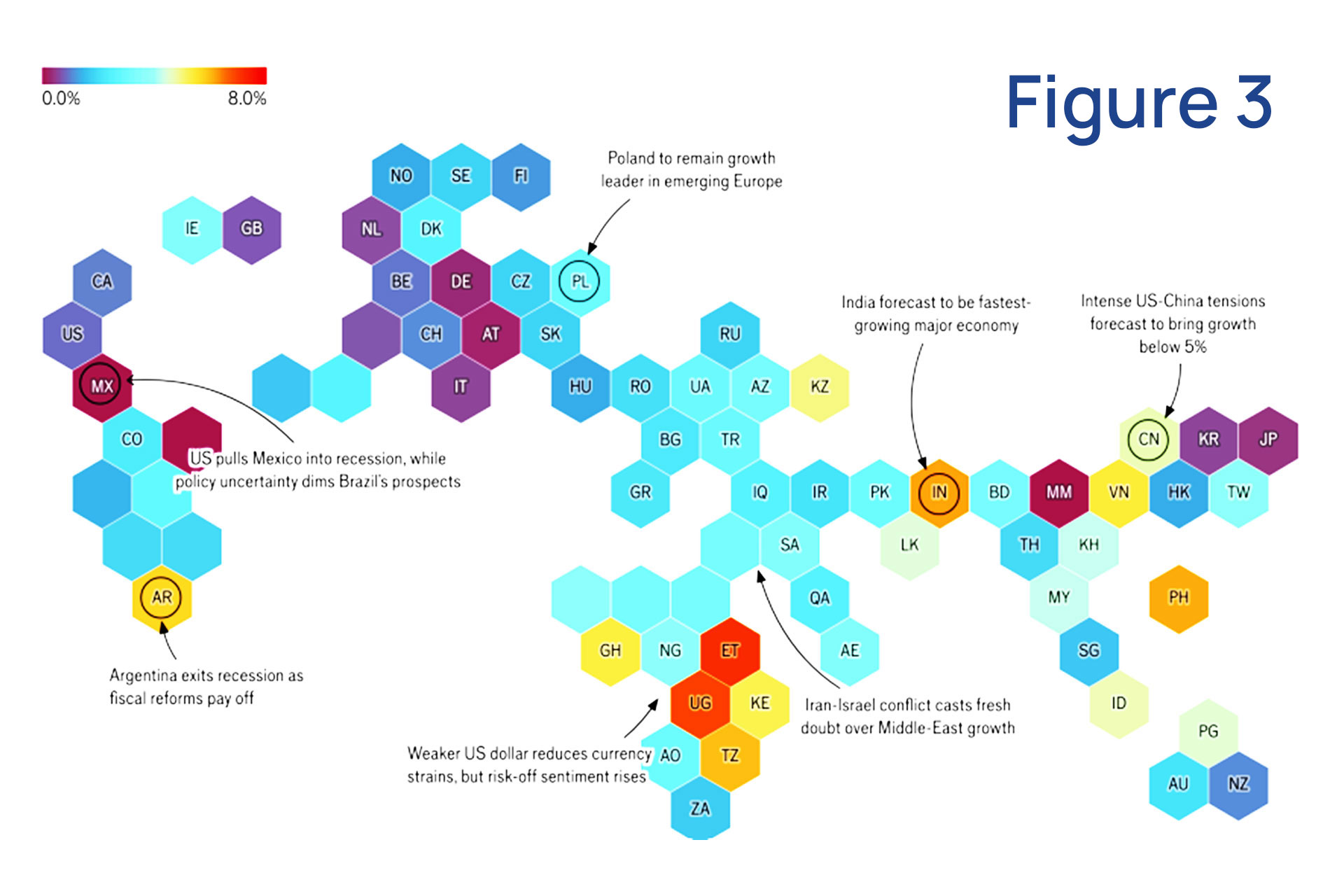

Looking ahead to FY2025/26 and calendar year 2025, the macroeconomic outlook remains cautiously optimistic. Global growth is projected at 3.3%, supported by continued disinflation and easing financial conditions, which are expected to provide a favourable environment for emerging markets.

Africa’s economic recovery is expected to gain further traction, supported by infrastructure expansion and improved policy frameworks. East Africa, in particular, is projected to maintain robust growth. (click on figure 3 to enlarge)

Uganda’s growth in FY2025/26 is projected to remain above 6.0%, driven by oil-related activity and continued investment in transport and energy infrastructure. Risks include fiscal slippage, election-related uncertainty, and delays in the East African Crude Oil Pipeline (EACOP) project. Preserving monetary discipline and accelerating structural reforms will be critical to sustaining investor confidence and long-term resilience.

Portfolio performance and strategy

The above economic developments impacted on our investment allocation decisions and performance during the financial year. The prevailing outlook will inform our investment strategy and priorities going forward.

The Fund’s portfolio is exposed to three major asset classes, namely fixed income (bonds), equity, and real estate. At the end of the financial year, 80.5% of the portfolio was invested in fixed income, 13.2% in equities and 6.4% in real estate. The allocation to fixed income increased during the year because of attractive yields, particularly in Uganda.

The allocation to equity remained largely unchanged while allocation to real estate declined. By market, the allocation to Uganda increased to 73.3% from 64.3% at the end of FY2023/24, attributed to the relatively attractive interest rate environment in Uganda. Resultantly, allocations to Kenya and Tanzania declined to 20.2% and 6.5%, from 25.7% and 10.8% respectively.

Fixed income: Strong returns realised, reinvestment risk ahead

The regional macroeconomic environment of FY2024/25 was highly supportive of fixed income performance as the low inflationary environment contributed to positive real returns.

The fixed income portfolio particularly benefitted from our country specific strategy, as we reallocated funds to the high-interest rate market in Uganda, amidst monetary easing cycles in Kenya and Tanzania. Over the year, the portfolio returned 14.1%, closing the year at a size of UGX 20.52 trillion and generating income worth UGX UGX 2.67 trillion.

Looking forward, as the monetary easing cycles progress across the region (particularly Kenya and Tanzania), reinvestment opportunities into fixed income in these markets are likely to remain low. Yields in Uganda are, however, expected to remain high in the first half of the financial year on the back of fiscal expansion, before moderating in the second half. This poses a significant downside risk to medium-term returns from the fixed income portfolio. Conversely, although less probable, upside pressure could arise from a shift in investor sentiment towards risk aversion driven by U.S dollar strength and heightened political risk which may offer support to long-term yields across the region.

In response to the prevailing market environment, the fixed income strategy will prioritise preserving yield advantage while advancing strategic initiatives aimed at enhancing long-term returns. Key focus areas include selective participation in high quality infrastructure financing opportunities and sustained stakeholder engagement on tax treatment of pension investments, both of which are critical to maximising long-term value for members.

Equities: Broad-based gains, diversification through alternative investments

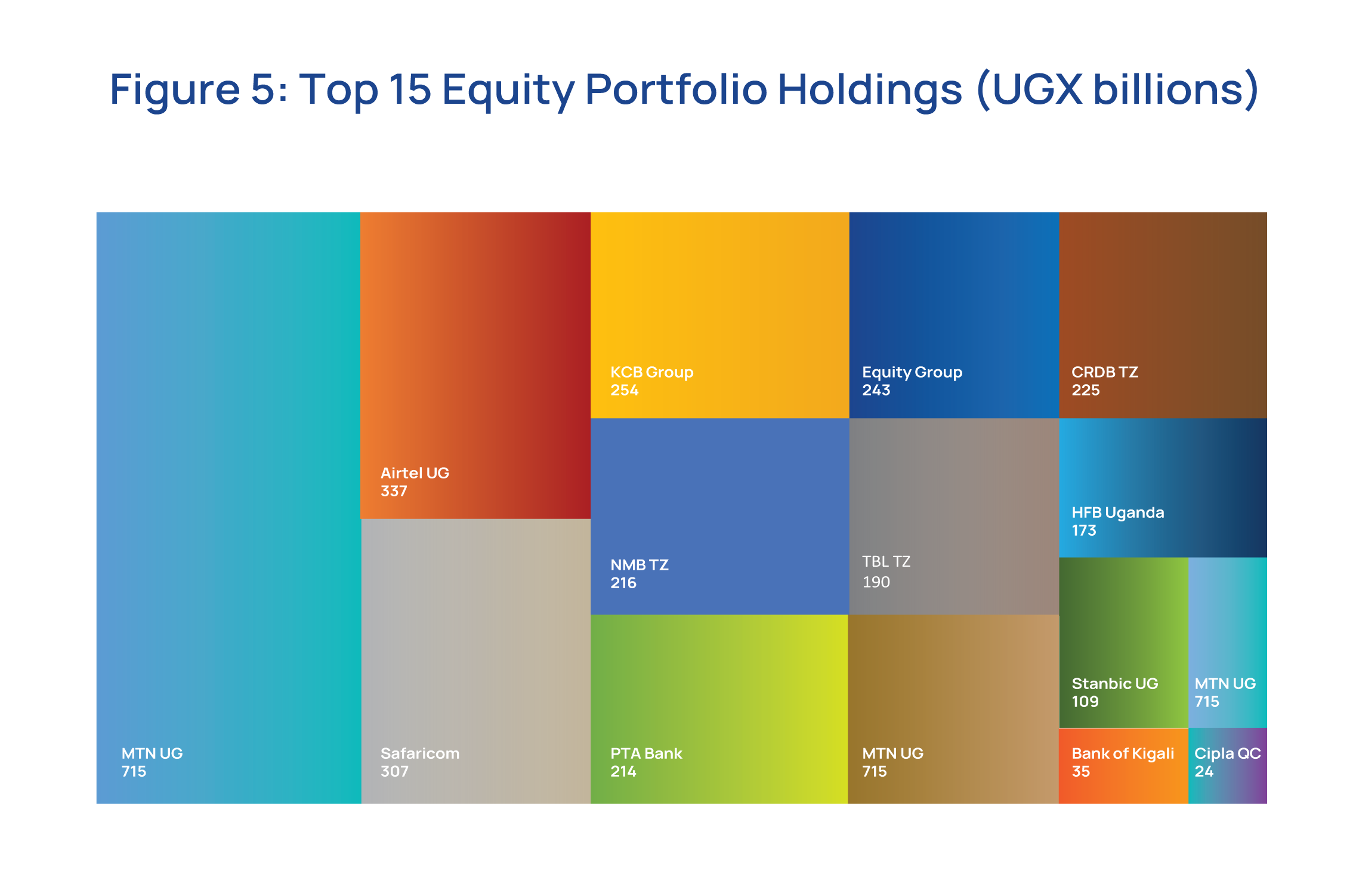

The equity portfolio delivered an impressive performance in FY2024/25, returning 25.2% to close the year at a size of UGX 3.39 trillion and generating UGX 795.55 billion in income.

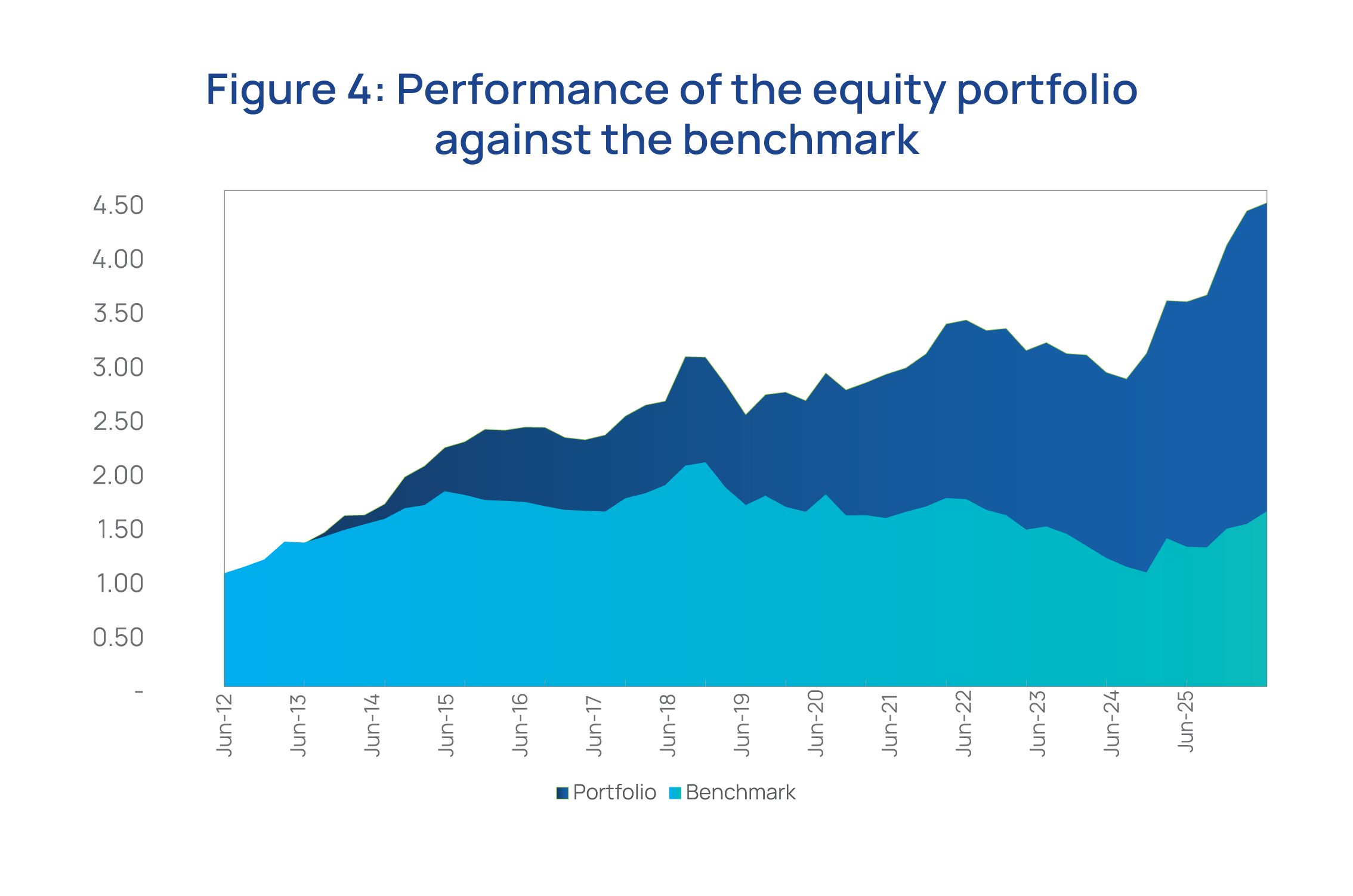

The portfolio continued to outperform its benchmark (Figure 4), driven by broad-based gains across listed counters in Uganda, Kenya, and Tanzania.

Despite political tensions in the region, particularly in Kenya, equity valuations were supported by falling interest rates, stable currencies, and resilient corporate earnings.

The portfolio was primarily driven by robust price appreciation among its top seven holdings, which collectively represented approximately 68.4% of total equity holdings as at year-end. Notable contributors included MTN Uganda (+53.6%), Airtel Uganda (+14.3%), Safaricom (+44.5%), KCB Group (+49.1%), Equity Group (+15.7%), CRDB Bank (+53.8%), and NMB Bank (+25.6).

Key developments in the portfolio during the financial year included the natural termination of the power distribution concession for Umeme Limited and a share repurchase agreement with the Trade and Development Bank (TDB).

- Umeme Limited: At the close of the concession, NSSF held a 25.27% equity stake in Umeme Limited, following a cumulative investment of UGX 153 billion over the 13 years since its initial public offering. During this period, the Fund received total dividends of UGX 244 billion, representing a cash-on-cash return of 159%. While the final payout is yet to be declared, the investment has been demonstrably profitable and has contributed meaningfully to economic and social development within Uganda’s energy sector.

- Trade and Development Bank (TDB): In line with a capital restructuring initiative approved by TDB’s Board of Governors aimed at aligning the institution with IMF criteria for multilateral development banks, TDB executed a share repurchase programme targeting non-sovereign shareholders. As part of this initiative, NSSF concluded a share repurchase transaction valued at approximately USD 59.5 million, following a decade-long investment totalling USD 30.2 million

Looking ahead, the regional equity environment presents a mix of monetary tailwinds and political watchpoints. Kenya is expected to remain a relatively stable anchor over the next year, while upcoming elections in Tanzania (2025) and Uganda (2026) may elevate near-term risk premiums. Nevertheless, structural earnings growth remains intact across the major sectors of exposure such as telecoms, banking, and consumer goods.

In this context, the equity strategy will continue to focus on long-term value creation, with increased diversification into alternative investment opportunities and pre-market listed brownfield private equity (hospitality, energy, and financial services). At the same time, the portfolio will maintain disciplined exposure to dividend-paying and fundamentally sound companies.

In view of the upcoming election cycles in Uganda and Tanzania, a tactical overweight in Kenyan equities is preferred in the short term. At the same time, the Fund will closely monitor volatility induced exits in the Ugandan and Tanzanian equity markets, which may present attractive entry points in select segments.

The overall positioning will aim to balance resilience, dividend, and long-term growth, as the portfolio shifts towards a more forward-leaning and impact-conscious equity strategy.