Member focused

Focusing on our members inspires us

Mr. Alex Rumanyika Kalimugogo, Head of Strategy and Performance

"What will the world look like in 2035? The safe answer is that nobody knows. A bolder answer is that we can shape it into what we want it to be. From the perspective of NSSF, we first asked ourselves this question in 2015, when our assets under management stood at UGX 5.5 trillion. Today, the Fund has surpassed UGX 25 trillion in value, a fivefold increase.

The size of this growth is not as important as what it represents: Trust. Our Board members are fittingly called trustees. Trust is the expectation our members hold that we are dependable and will deliver on our promises. In our business, many things happen every day, but without public trust, success would be impossible."

The first and most important promise was to keep our members’ money safe. Safe means that their savings will be available when they are ready to claim them and will have grown in real value during the time they were in our custody.

The second promise was to serve them conveniently, delivering quick, secure, and accessible service, anywhere and anytime.

Finally, we promised to be an innovative financial wellness partner, helping our members strengthen their financial resilience.

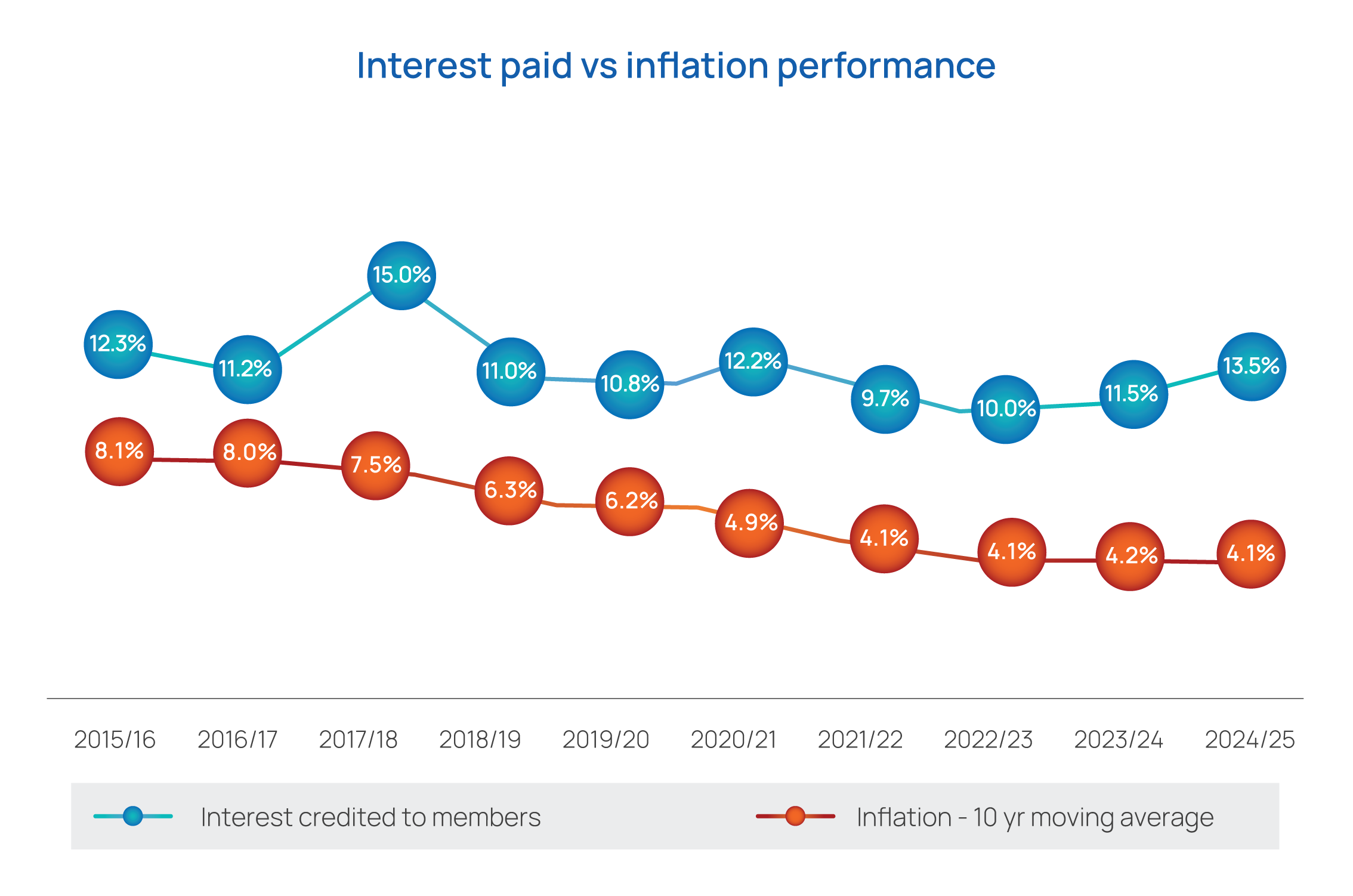

To uphold the promise of safety, we invest with the goal of ensuring members’ savings earn a return at least 2% above the 10-year moving average inflation rate.

Over the last 10 years, we have exceeded this target, delivering an average return of 5.6% above inflation.

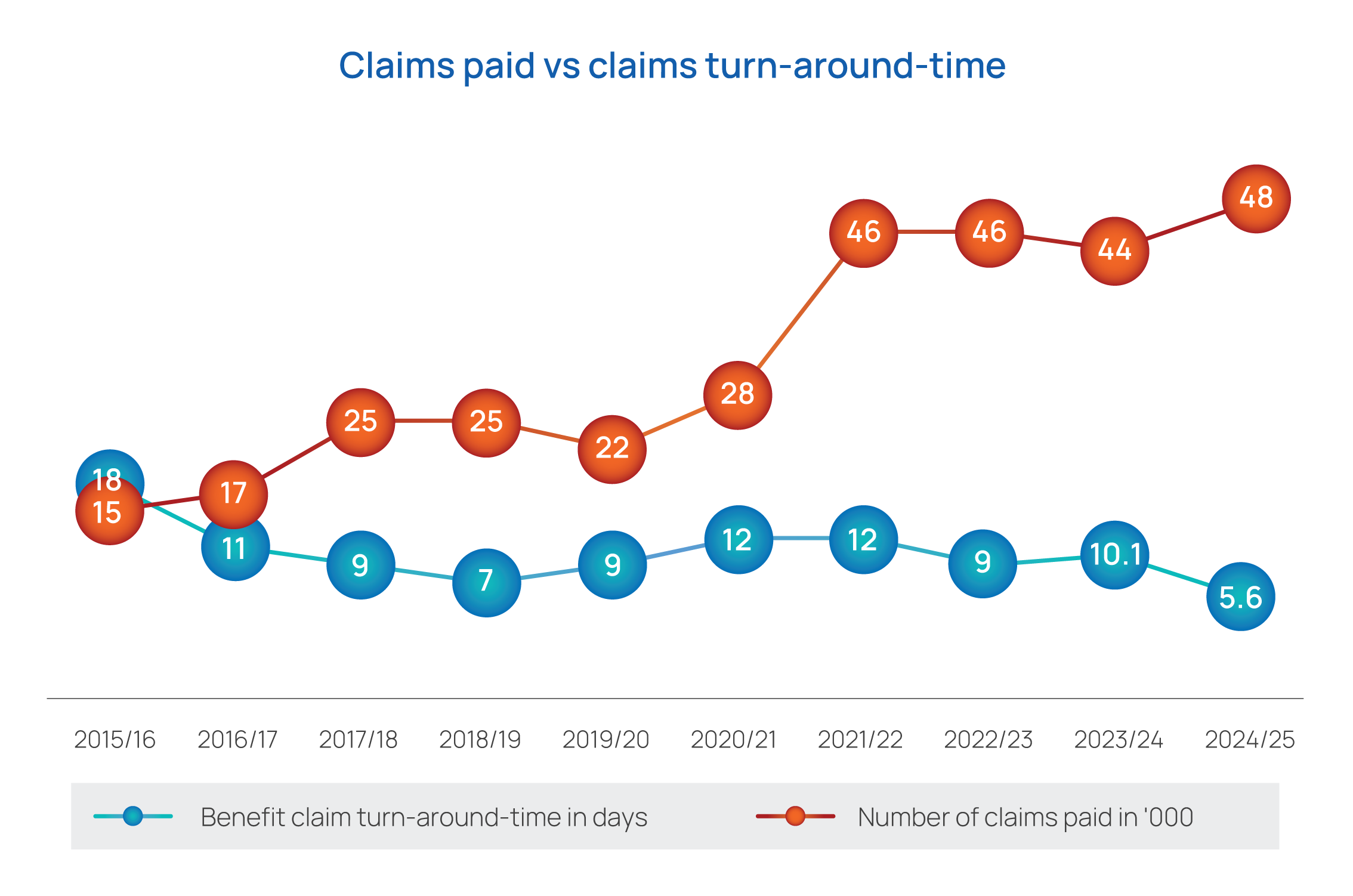

Since 2015, we have paid out over 300,000 claims. Most notably, during the disruptions caused by Covid-19, we introduced a new benefit– mid-term access – which became the ultimate test of trust.

In just one year, the number of claims rose sharply from 28,000 to 46,000, with UGX 1.1 trillion paid out in benefits. Despite this sharp increase in both the value and volume of claims, our average turnaround time steadily improved to just four days, with some claims being paid within 24 hours.

To improve the financial resilience of our members, we focused on financial literacy. Over one million participants have benefited from our training workshops, delivered both in person and digitally. In 2024, supported by amendments to the NSSF Act, we introduced our voluntary saving product – Smartlife Flexi.

This product speaks to our purpose of making life better through savings as a lifestyle. With most workers today earning a living through informal and unstructured labour – often in small, irregular payments, Smartlife Flexi provides a flexible way to save, earn competitive interest and access their savings when needed.

We are now building additional social security benefits, such as healthcare and housing, around this savings ecosystem. This marked the fulfilment of our last promise – to be an innovative partner in enhancing our members’ social security. Launched in November 2024, Smartlife has attracted 27,194 new members and UGX 17.2 billion in voluntary contributions.

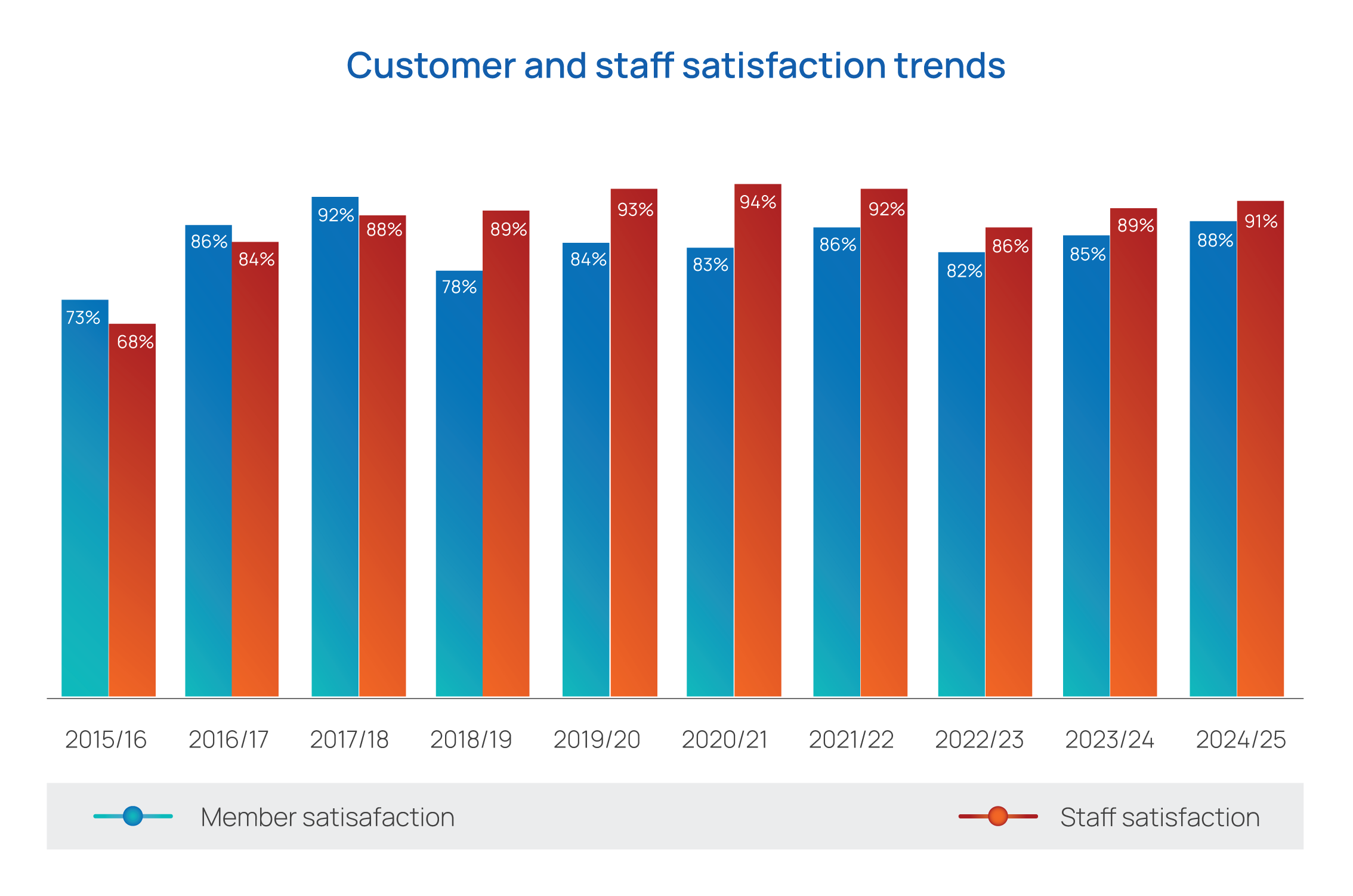

Most say they are – 88% to be precise. While this falls short of our 95% target, it is well above the global customer satisfaction rating for financial services.

The success of this transformation was centred around our people. We have created a work environment that incentivises and rewards productivity. At the heart of our people strategy is wellness. The physical, mental, and financial wellness of our people. They have reciprocated by living up to the Fund’s core value of putting the member at the centre of everything they do.

Below are survey results of how staff members resonate with the Fund’s core values.

Focusing on our members inspires us

Doing more, doing better with what we have

Different skills, one body, one purpose

Truthful in our actions, responsible for our decisions