Our Performance

CIO's business review

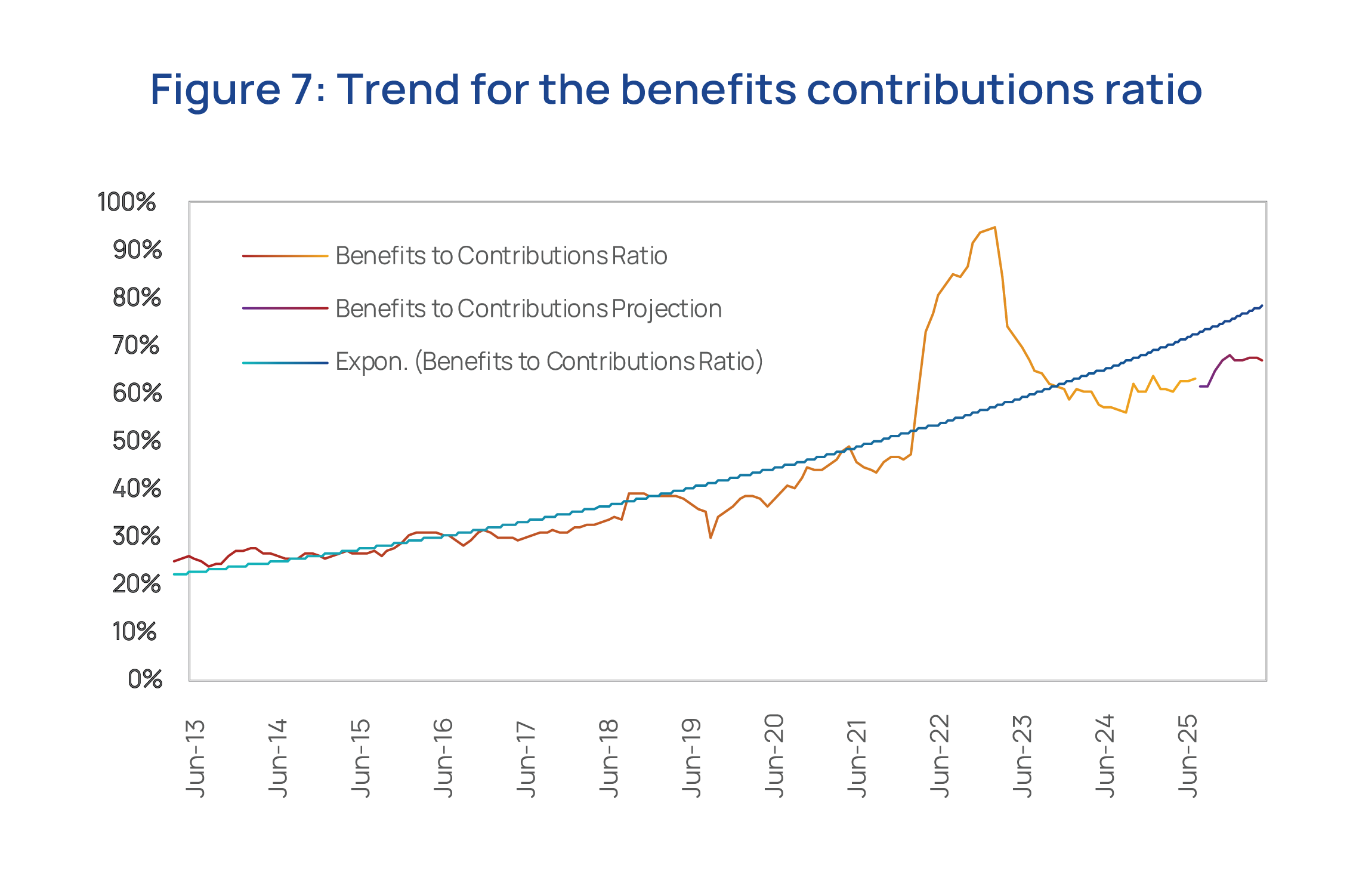

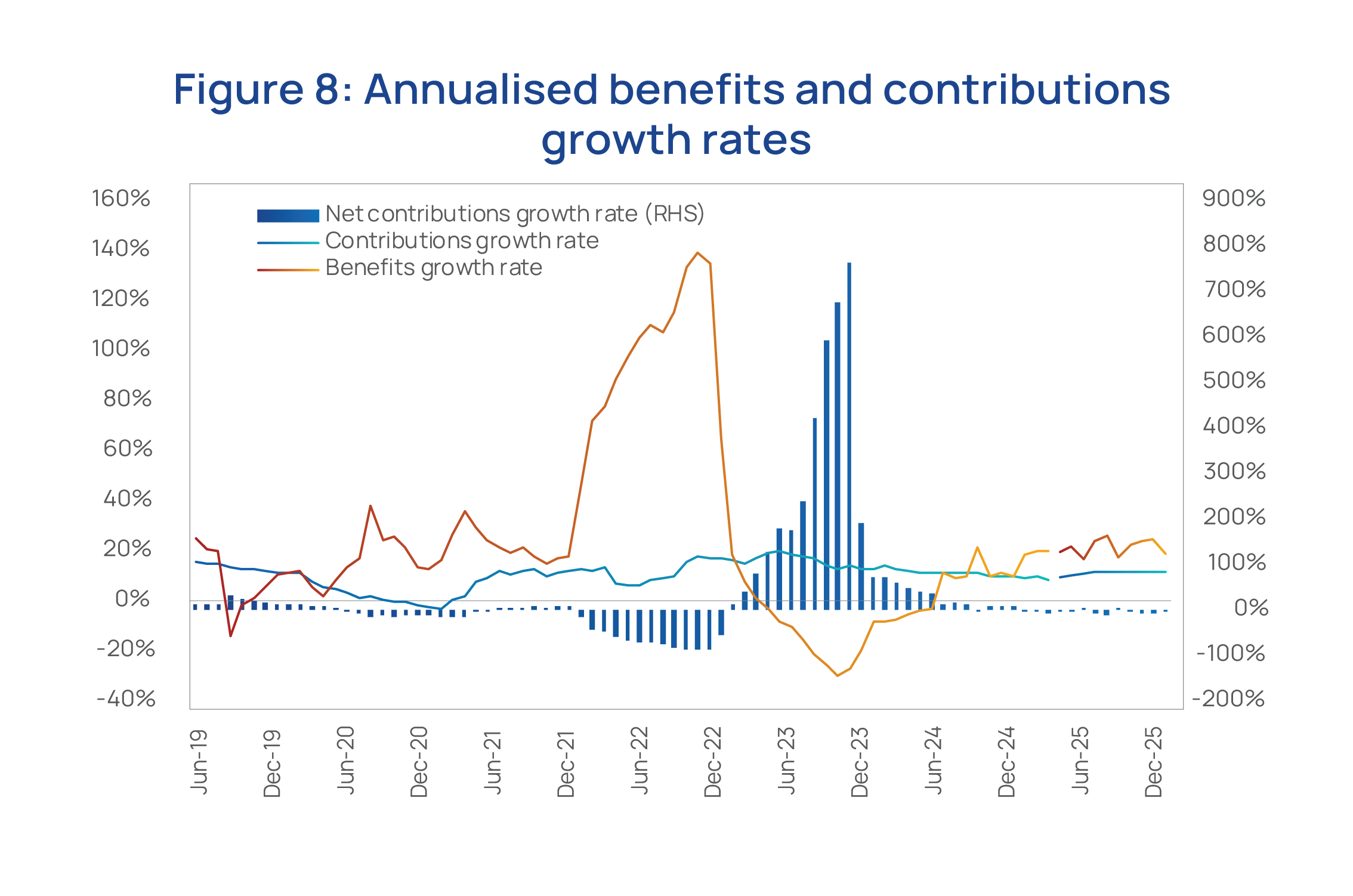

Contribution flows continued to exhibit a close, albeit lagged, correlation with Uganda’s nominal GDP growth while benefits flows were driven up by age-related benefits. The annual growth in benefits (18.0%) remained higher than the annual growth in contributions (10.1%), increasing the benefits contributions ratio for the year.

This ratio, which spiked following policy reforms on mid-term access, stabilised within the financial year and reverted to its historical long-term trend as mid-term benefits tapered (Figure 7).

All factors constant, the ageing of the fund is projected to continue tapering any growth in net contributions (Figure 8), impacting liquidity over the long term.

In response to these structural trends, and building on the reform momentum established through the NSSF (Amendment) Act, 2022 and the accompanying Voluntary Contributions and Benefits Regulations, 2024, the Fund introduced a new initiative to expand the contribution base and enhance long-term liquidity.

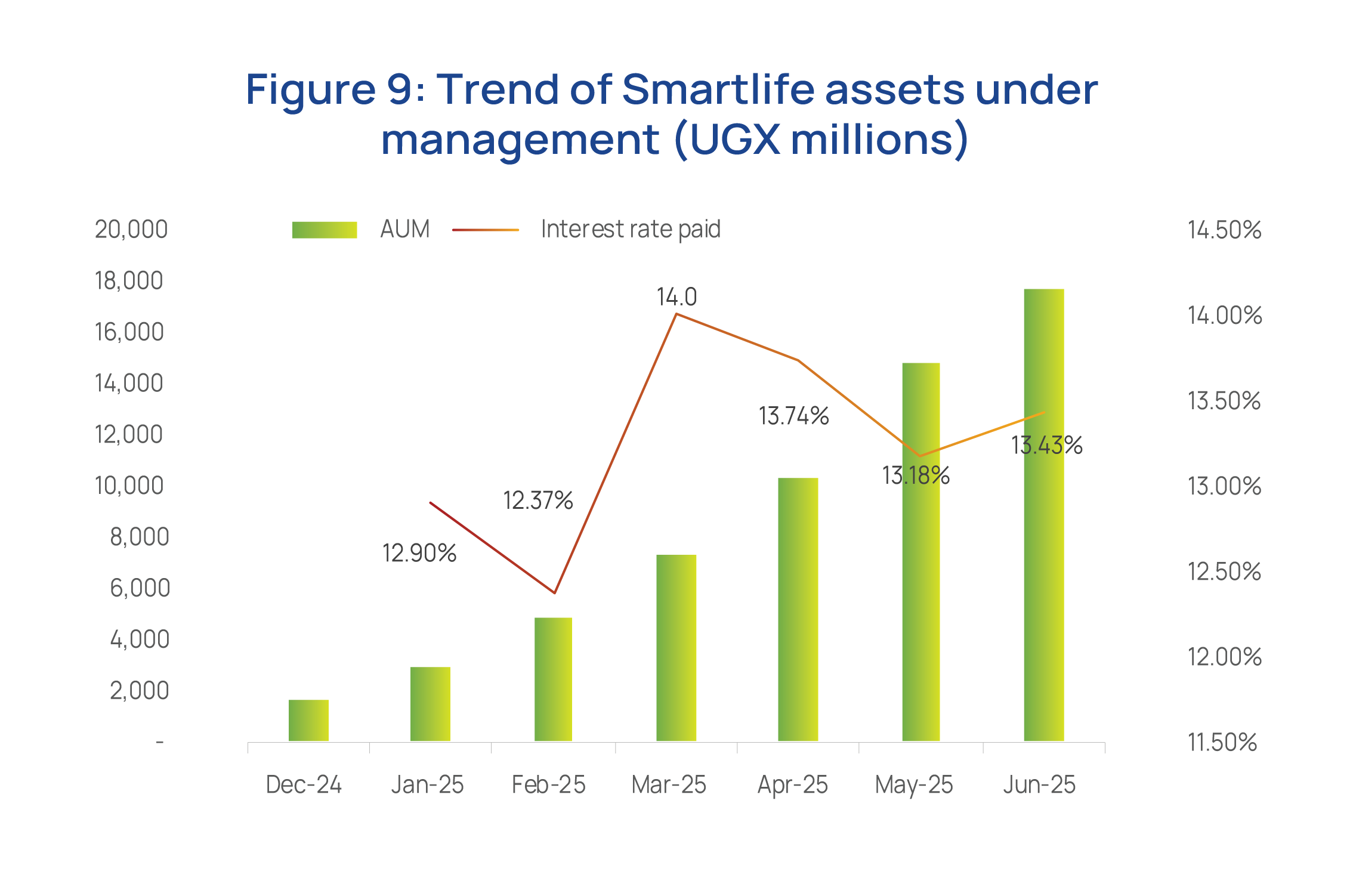

In November 2024, we launched the Smartlife Investment Plan, a voluntary savings product tailored to individuals seeking to build long-term wealth outside the mandatory contribution framework. The initiative was designed to attract both self-employed individuals in the informal sector and formally employed savers looking to top up their savings, offering flexible contributions and the benefit of compounding returns under the Fund’s investment management framework.

Between November 2024 and June 2025 (Figure 9), Smartlife attracted contributions worth UGX 17.2 billion, signalling early traction and laying the groundwork for a more diversified and inclusive contribution base. The trend of interest rates paid per month also increased, from 12.9% paid in January 2025 to 13.43% in June 2025.

Looking ahead to FY2025/26, the Fund anticipates maintaining a robust cash flow position, with a strategic focus on enhancing yields across its diversified asset portfolio. Active risk management will remain central to the Fund’s approach, ensuring resilience against potential disruptions arising from both domestic and global economic developments.

The treasury strategy will therefore remain focused on allocating excess funds towards implementation of the strategies discussed across the asset classes, with an aim of smoothing out cash flow volatility, and preserving member value over the long term.

Key messages and takeaways

UGX 50Tn

95%

Over the past four decades, NSSF has evolved from a modest pension fund into a UGX 26 trillion institution, consistently delivering strong returns and long-term financial security for its members. FY2024/25, the final year of the Vision 2025 strategy, marked a significant milestone, exceeding the strategic asset target by 30%, delivering a high 13.51% return, and reaffirming the Fund’s commitment to preserving and growing member value in real terms.

Beyond individual member accounts, NSSF’s investments have played a transformative role in shaping Uganda’s physical and economic landscape through landmark real estate developments, strategic enterprise financing, providing support to the government fiscal programme, and deepening of capital markets.

Looking ahead, the 2035 Strategy charts an ambitious path to double assets under management to UGX 50 trillion.

Achieving this vision will require disciplined portfolio stewardship, agility in navigating evolving market dynamics, and a sustained focus on balancing income generation with long-term growth.

NSSF’s journey affirms that a member-centric, well-governed institution can not only secure the financial futures of millions but also serve as a catalyst for national development and economic resilience.