Our Governance

Our governance approach

To give effect to our governance approach, we have a formalised governance framework. This framework outlines our commitment to comply with relevant legislation and regulations and is supplemented by the application of governance best practice relevant to the business.

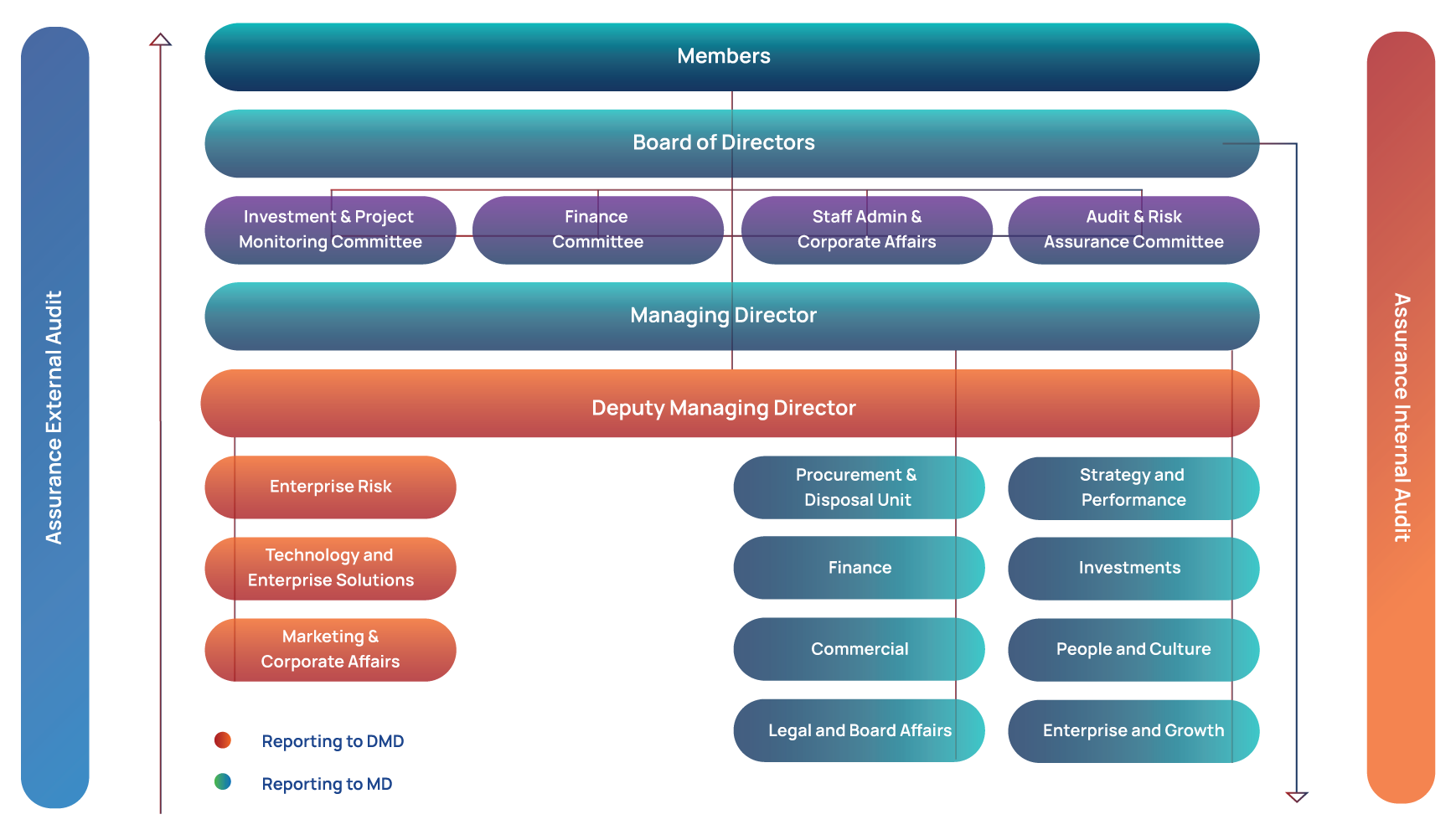

The governance structure of the Fund is depicted in the NSSF Governance Structure diagram, which illustrates the interaction between the members and the Board. This diagram highlights how the Board Committee structure supports the relationship between the Board and the Managing Director (MD) while showing the delegation flow from members.

We have established strong processes to ensure that delegation moves effectively through the Board and its Committees to the MD and Executive Committee (EXCO) throughout the organisation.

Concurrently, accountability flows upward from the Fund to its members. This approach helps to strengthen alignment and maintain open communication with our Members and all stakeholders.

Our approach to governance in response to changes in our operating environment

Considering the rapid evolution of local and global trends, we are aware of the need to continually strengthen our governance approach and framework, ensuring they remain robust enough to respond to and adapt to these changes.

Trend

The rapid acceleration of technology, especially in AI, emphasises the need for robust cybersecurity and data privacy protection.

Our governance response

NSSF has implemented robust cybersecurity and data privacy measures to tackle challenges from rapid technological advancements, including AI. Key initiatives include regular vulnerability testing, deploying advanced monitoring tools such as Dynatrace, leveraging AI for operational efficiency, and transitioning claims applications to digital formats to mitigate risks.

The organisation has developed in-house compliance modules, implemented an ERP system for centralised data security, and provides cybersecurity training for staff. Advanced data analytics is used for member insights while enhancing the whistleblower platform for secure reporting. Collaborations with external entities such as the Financial Intelligence Authority (FIA) to address money laundering trends, and regular IT governance audits ensure alignment with best practices.

Trend

ESG factors are becoming more important in business practices.

Our governance response

With the growing emphasis on ESG factors, our engagements with external stakeholders are crucial. The MD addressed our sustainability commitments at the East Africa Carbon Market Forum 2024, outlining our 2025/26 strategy to explore carbon projects for sustainability and poverty reduction. At the AMM in September 2024, the MD highlighted our net zero carbon emissions policy for investments and 98% paperless operations. Additionally, through the Hi-Innovator programme, we supported organisations such as Ecoplastile Limited and Eco Stove, which produce efficient stoves that reduce carbon emissions and improve indoor air quality, enhancing health and safety for households and businesses.

Aligned with ESG principles, the Fund integrates “Green” procurement initiatives into its procurement and contract management processes. This promotes environmental protection, social inclusion, and innovation by prioritising practices that reduce, reuse, and recycle materials.

Trend

Strengthening the alignment of strategy with risk governance.

Our governance response

Initiatives to integrate risk governance into NSSF’s decision-making, promoting resilience, sustainable growth, and value creation for its members include: comprehensive frameworks, including Enterprise Risk Management and Strategic Asset Allocation, to identify and manage risks effectively.

The Risk Appetite Framework integrates risks and opportunities with strategic objectives, while the Three Lines of Defence Model clarifies responsibilities for risk-taking and control functions. The ARC oversees risk management and compliance, and a process is in place to identify significant risks affecting value creation. The Combined Assurance Model promotes collaboration across teams to ensure comprehensive risk coverage, while continuous monitoring of risk exposures supports alignment with strategic objectives.

Trend

An unstable geopolitical landscape leading to uncertainty and economic volatility.

Our governance response

NSSF addresses the unstable geopolitical landscape through robust risk management strategies, diversifying its investment portfolio across countries, asset classes, sectors, and currencies while closely monitoring economic conditions. The Fund engages in partnerships to mitigate risks, supports compliance efforts, and adapts its investment strategies to tackle challenges such as currency fluctuations and market volatility. NSSF emphasises long-term investments, prioritises sustainability and responsible practices, and aims to create resilience and sustainable value for its members amid geopolitical uncertainties.