Our Performance

CIO's business review

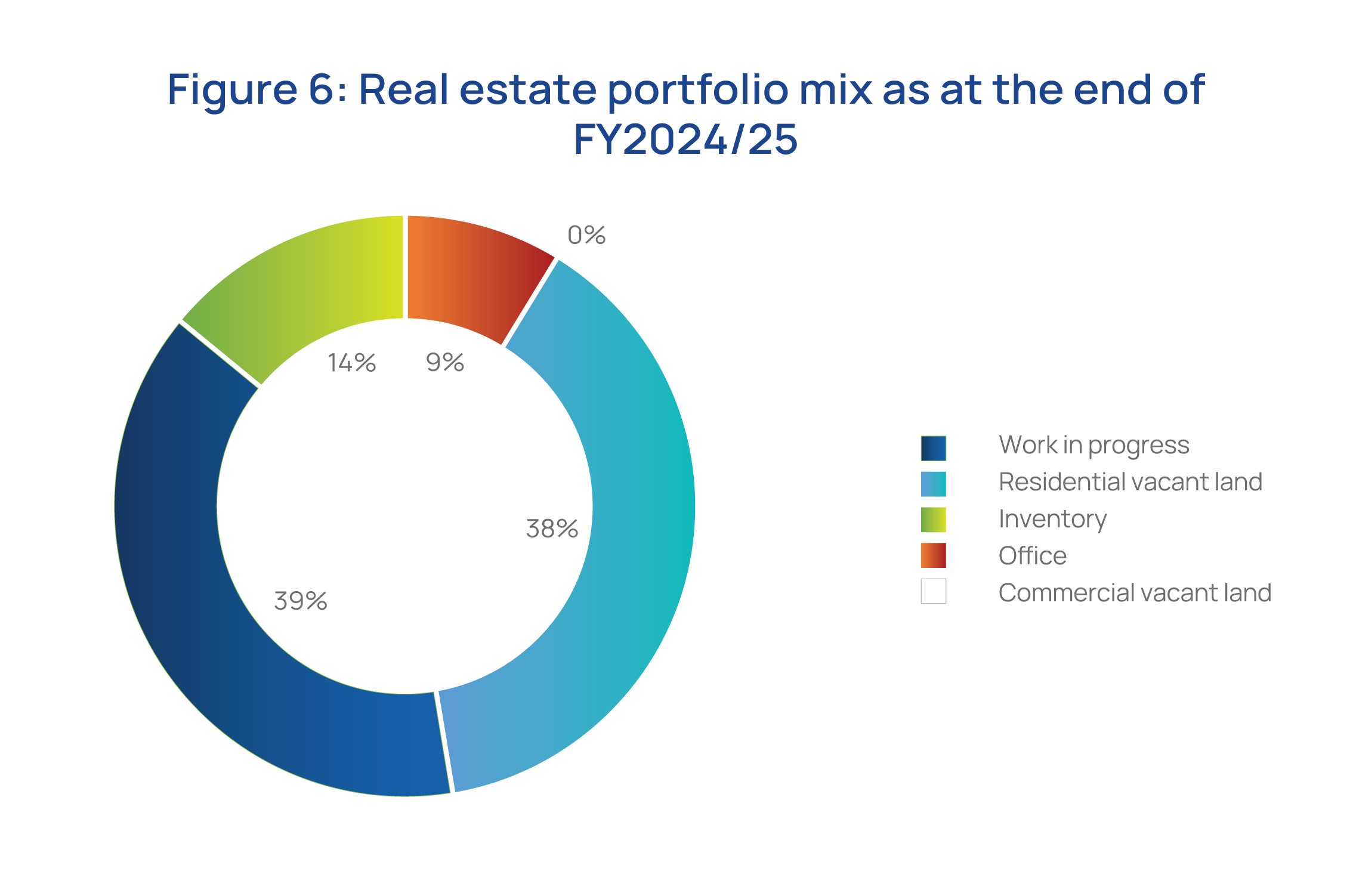

Over the past financial year, the real estate portfolio delivered a modest return of 2.0%, ending the year at a size of UGX 1.60 trillion and generating income of UGX 35.32 billion. This performance was supported by the portfolio mix (see figure 6 below), providing for resilient occupancy in completed income generating property, inventory sales, and a growing pipeline of development activity.

Real estate market conditions remained mixed. The office sub-sector saw stable prime rents but faced softening demand amid growing vacancies and the end of several USAID and NGO-funded leases.

Retail assets recorded increased occupancy and tenant expansion, particularly in well-located malls with improved road access, though consumer footfall declined slightly according to Knight Frank reports.

In the residential segment, rental demand strengthened in suburban areas, driven by cost-conscious tenants and shifting preferences for modern, spacious units in less congested neighbourhoods. Despite this, prime residential occupancy dropped marginally, and high-end sales slowed due to oversupply and limited buyer activity.

In response, the Fund executed a strategic sales revitalisation campaign for the Solana Lifestyle and Residences project starting January 2025, to stimulate sales and reduce inventory.

Table 2: Solana Lifestyle and Residences Sales

Total units: Dec-24: 306 , Jun-25:306

Units offered: Dec-24: 34, Jun-25:195

Available units: Dec-24:272, Jun-25: 111

Indeed, the market responded positively with sales velocity increasing six-fold, from 34 units sold as at end December 2024 to 195 units sold by the end of June 2025 (Table 2). The campaign therefore reflected a proactive approach to unlocking value.

Looking ahead, the Fund’s real estate strategy will focus on unlocking value through the pre-sale of close to completed and sale of completed inventory. Strategic emphasis will be placed on delivering affordable housing solutions within high-growth corridors of Greater Kampala, aligned with evolving market demand and urban development trends.

Future developments will increasingly incorporate green building standards to enhance environmental sustainability and improve tenant appeal. To support efficient project execution and lower the cost of capital, the Fund will continue to pursue low-cost financing options and explore viable public–private partnership models.

While the office segment remains exposed to oversupply risks, targeted realignment initiatives and proactive tenant retention strategies will be implemented to safeguard income streams and optimise long-term asset performance.

Treasury and cashflow dynamics: Anchored in income, aligned for growth

The Fund sustained a strong liquidity position in FY2024/25, underpinned by positive net contributions and robust investment income. Cash inflows from contributions and investment income stood at UGX 5.26 trillion during the year while the outflows from benefits and operations stood at UGX 1.53 trillion, allowing the Fund to invest member funds while meeting its obligations.

Investment income was the dominant source of inflows at UGX 3.13 trillion, while contributions and benefits recorded at UGX 2.13 trillion and UGX 1.32 trillion respectively. This provided for net contributions of UGX 805.15 billion.

Investment income was the dominent source of inflows, totalling:

Contributions during the year amounted to:

Total benefits paid out to members during the year amounted to:

The Fund’s net contributions for the year were recorded at: